Balancing sustainable income and growth potential in your Living Annuity

30 October 2024

With crucial decisions to be made for your financial future, it can often feel overwhelming to start preparing for retirement. How will you combat inflation as you transition into your golden years? And what will you decide to do with your savings? The good news for stressed-out pre-retirees is that there are financial products and tried-and-true methods out there to help you secure a comfortable future post-retirement. One of these financial products is a living annuity, and understanding the interplay of forces acting on your living annuity investment (which can be put into a formula we like to call the Golden Equation) will ensure you never run out of money in retirement.

The way a living annuity investment is structured allows an investor to strike a balance between the income drawn from it, and the potential for that investment to grow in the years to come. So, how do retirees ensure they generate sufficient and sustainable income from their living annuities, while ensuring purchasing power doesn’t diminish because of inflation, and still allow room for growth? Below we’ll answer these questions so that you can make an informed decision about the relevance of a living annuity to your retirement plans.

Did you know? The 10X Living Annuity offers a flexible savings solution for your retirement, allowing you to achieve the ideal balance between income and growth. Through adjustable drawdowns, diversified asset allocation, up to 100% offshore exposure, low fees, and complete transparency, 10X allows thousands of clients to invest their savings strategically for a comfortable retirement. Speak to an experienced investment consultant to learn more.

Plan for a comfortable retirement with our

Living Annuity calculatorLiving Annuities: A Quick Recap

Let's get started with a birds-eye view on living annuities. When you retire, you have two options for receiving your retirement income: a living annuity or a life (guaranteed) annuity. The key differences between a living annuity and a life (guaranteed) annuity lie in flexibility and risk.

A living annuity allows you to control investment decisions and withdrawal rates, and also offers inheritance benefits, but carries some investment risk. A life (guaranteed) annuity, on the other hand, generally guarantees a fixed income for life, regardless of market performance, providing security but no flexibility in income adjustments or inheritance for beneficiaries.

For those who wish to have more flexibility and agency over their withdrawals, as well as their investments, living annuities are usually the better option. You can read more about the key differences between living annuities and life (guaranteed) annuities here.

A living annuity is a retirement savings investment product designed to provide you with a means of receiving a regular income after retirement. Once you reach retirement, a living annuity allows you to continue growing your retirement savings, and you would do this by investing your savings according to your investment goals and risk tolerance. You would then draw down a retirement income set at a percentage of your choosing (between a minimum of 2.5% and a maximum of 17.5%).

Picture having the financial freedom to sit back after your retirement and truly enjoy your hard-earned savings, while still having an active say in your financial future. A living annuity gives you the freedom to choose how much income to take each year. Whether you want to sprinkle in travel, take up a hobby you’ve never had the time for, or simply enjoy some well deserved downtime, a living annuity allows you to tailor your withdrawals to fit your lifestyle.

But the flexibility associated with a living annuity investment doesn’t end there. You are able to change the investment structure of the annuity itself. In other words, the underlying funds you invest in are ultimately your decision. This structure can be tailored to suit your needs, but more significantly, your risk tolerance. While you might have more appetite for risk when you retire, after a few years you might want to have a greater allocation of defensive assets (such as cash and bonds) in your portfolio – with a living annuity, you are able to make this adjustment to your investment.

9 out of 10 people do better with 10X

Asset Allocation: The Key To Preserving Wealth

When it comes to preserving (and even growing) your capital, strategic asset allocation – or making sure your money is invested in the right underlying assets at the right time – is key. If the biggest threat to retirement income is high fees (and it is), the correct asset allocation allows you to balance growth potential and stability in your living annuity. By diversifying your investments and including offshore assets, you can better navigate market volatility and inflation while ensuring a stable income throughout retirement.

Each asset class comes with its own level of risk. It would be as unwise to invest exclusively in assets with high growth potential (and therefore higher risk) as it would be to play too defensively and try to eliminate all risk altogether. While longer timelines allow for a higher concentration of growth assets, older investors who have been retired for a while might not want to expose themselves to sudden fluctuations in the markets and associated downside risk. The correct asset allocation, regularly reviewed, can mean market risks are managed while the investment provides a sustainable income – obviously, assuming the drawdown is managed efficiently as well.

Equities can be a volatile investment, as share prices are subject to market changes and are thus constantly in flux. That said, investing in equities can provide a great opportunity for long-term growth in your portfolio. Equities usually offer higher returns over time, which makes investing in them ideal for those with longer time horizons who wish to grow their capital during market upswings. For retirees looking to outpace inflation, having equities as part of your asset allocation (and often, a significant part) is key for long-term growth.

Bonds are investments that provide a fixed income, while cash is money itself. Both bonds and cash are referred to as defensive assets, as they tend to at least keep pace with inflation and therefore preserve buying power with less associated risk than equities or property. Both are less volatile than equities, offering more stability in your portfolio.

Investing offshore through a living annuity opens access to global markets and provides diversification against local, country-specific risks (such as the Rand going into freefall). Unlike retirement funds restricted by Regulation 28, living annuities allow up to 100% of assets to be invested offshore, offering potential for international growth. This can reduce reliance on the local economy and diversify across currencies and industries. However, managing currency risk is essential, and our data suggests an allocation of 40%-60% offshore is optimal for South African, Rand-based investors. In short, balancing local and offshore exposure should align with how the rest of your money is invested, your financial goals and time horizon – you can read more about offshore investing here.

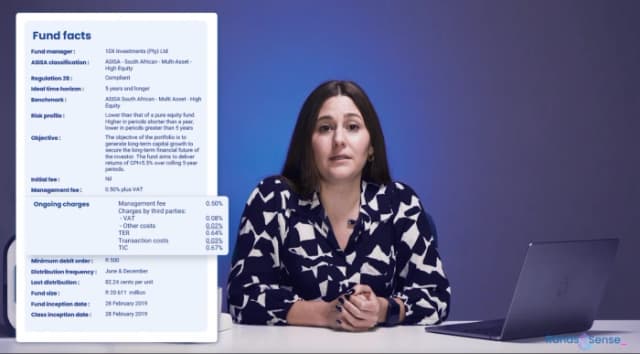

As mentioned, 10X offers diversified portfolios to allow investors to strike the ideal balance between risk, returns and growth, and this is exemplified by the 10X Your Future Fund. The fund’s diversification across all asset classes and global markets ensures our clients’ portfolios can withstand tricky fluctuations in the domestic market.

Low Fees: Enhancing the Potential for Capital Growth

Balancing your risk, returns, and drawdowns (income) can be challenging when you are expected to pay excessively high investment management fees, particularly in retirement, when you may not have other sources of income. High fees can end up eroding your investment returns, and even small fee increases can lead to a significant negative impact on your capital growth over time.

Consider Alice and Bob, each starting with an initial investment of R100,000. They both plan to invest for 30 years, targeting an average annual return of 6%. However, the fees they pay differ significantly. Alice invests with a traditional provider that charges an annual fee of 2%, while Bob opts for a low-cost provider like 10X, where the annual fee is only 0.86%.

After accounting for fees, Alice’s net return is reduced to 4% per year, while Bob enjoys a higher net return of 5.14%. Over 30 years, this difference has a significant impact. Bob’s investment grows to approximately R438,700, while Alice’s investment only reaches R324,300. The 1.14% difference in fees results in Alice’s portfolio being R114,400 smaller by the end of the period.

This example highlights the profound effect that even small differences in fees can have on long-term investments. The importance of selecting low-fee investment options cannot be understated, especially when it comes to retirement.

It’s important to note that this example is simplified for clarity. It does not account for inflation or drawdowns. While both Alice and Bob will experience the same inflation rate, which erodes the future buying power of their investments, this effect has been excluded here to focus on the impact of fees. Similarly, their drawdowns can also affect their investment growth, but these have been left out for illustrative purposes. This example underscores the importance of low fees in retirement planning, but other factors, like inflation, market fluctuations, and drawdown rates are also critical to consider for a complete picture.

To learn more about the compounding effect of high fees, the benefit of low fees, inflation, drawdowns, and how to avoid running out of money in retirement, take a look at this handy breakdown.

At 10X, we promise a low-fee structure that is completely transparent for our clients. Moreover, we do not charge upfront fees, advice fees, or exit fees – unlike most traditional providers. By keeping these costs to a minimum, we ensure our clients receive better returns on their living annuity portfolios, even giving them the chance to reinvest said returns to further enhance their capital growth. A retiree investing R5 million in a 10X Living Annuity could see a significantly larger balance after 20 years compared to a traditional high-fee provider, purely due to the effect of lower fees.

You can see for yourself how these small variances in fees can drastically affect your returns by using the free EAC calculator on our website and requesting a free cost comparison to see how much you could be saving with 10X.

Strategies For Sustainable Drawdowns

As we’ve discussed, living annuities allow you some flexibility when it comes to the amount of income you want to receive. The income you earn from your living annuity is referred to as a withdrawal or a drawdown from your fund, and works on a percentage basis. In South Africa, the minimum drawdown rate is 2.5% of your fund and the maximum rate is 17.5% of your fund, as set by SARS. These limitations are meant to ensure your assets remain protected and help you manage your living annuity responsibly and sustainably.

Living annuities are also subject to certain rules set in the terms and conditions agreed to with your product provider. It’s also important to note that you cannot cash out your entire living annuity; all you can do to increase your withdrawals is to increase your drawdown rate. To do this, you have to choose your drawdown rate annually before your policy enters a new year. Withdrawals can be made monthly, quarterly, semi-annually, or annually depending on your needs.

Retirees can adjust their drawdowns annually based on changes in their income needs and the conditions of the market. Lower withdrawal rates are more sustainable, as they ensure you receive the income you need without jeopardising your capital, and allow for the possibility of capital growth. Higher drawdown rates, on the other hand, can lead to your savings being rapidly depleted, particularly if market conditions worsen. An effective strategy many retirees employ is to withdraw the delta between the investment’s ROI and the capital value after inflation and fees are taken into account. So, if you’ve invested R1,000,000, inflation is 6%, you’re paying 0.86% in fees, and the return on your investment is 12%, a sustainable drawdown would be 5.14% or R51,400. This preserves the integrity of the overall investment.

With a living annuity, you can also adjust your withdrawals each year based on your portfolio’s performance. This allows you to take more if the market is doing well and less if it isn’t, but also, keeping your drawdown the same when your investments are performing allows for that investment to grow – which is one of the big benefits of a living annuity. Regardless of your strategy, it’s crucial to notify your annuity provider before your policy anniversary, as they will continue with your previous withdrawal rate if not instructed otherwise.

Many people adhere to the common 4% rule, a concept that comes from the statistical analysis of the intersection of fund performance and inflation (and assumes reasonable fees). This analysis revealed that constant, non-volatile spending is an effective strategy to achieve capital growth and preserve capital simultaneously.

The 4% rule is a retirement guideline that suggests you can safely withdraw 4% of your retirement savings annually to ensure it lasts for about 30 years. The idea is that this rate balances withdrawals, inflation, fees and investment preservation, minimising the risk of depleting your funds. In a nutshell, the 4% rule is widely accepted to be a sound method to ensure your capital grows with inflation, regardless of fluctuations in your investments.

If you retire with R5 million, the 4% rule suggests you can safely withdraw R200,000 in your first year. In the following years, you would increase withdrawals in line with inflation. For example, with 6% inflation, your second-year withdrawal would rise to R212,000 to maintain your purchasing power. To preserve and grow your savings, your portfolio must generate enough returns to cover fees, inflation, and withdrawals.

While the 4% rule is based on historical return trends, which may not always repeat, it generally provides a good chance of ensuring your savings last throughout retirement. However, not everyone may have a 30-year horizon, or be able to live on 4% of their savings. Your optimal drawdown rate ultimately depends on your personal circumstances. Tools like the 10X Living Annuity Calculator can help determine the best sustainable withdrawal rate for your situation.

Evolved from the above, the Golden Equation is a formula retirees can consider to ensure they don’t deplete their savings. Put simply, the equation ensures your withdrawals, fees and inflation never outweigh your return on investment. The equation is simple, as you can see below:

Drawdowns + Fees + Inflation ≤ Return on Investment

Let’s explore how different strategies play out by following two investors: Kyle and Sue.

Kyle invests R1,000,000 with 10X Investments, which charges a low fee of 0.86% annually. His portfolio delivers a 10% annual return before fees. Kyle follows the 4% withdrawal rule, initially drawing R40,000 per year, with annual increases aligned with 5% inflation.

After fees and inflation, Kyle's net return is 4.14% annually. Since his drawdowns, fees, and inflation do not exceed his investment returns, his savings continue to grow over time. Even with the annual inflation adjustment to his withdrawals, Kyle’s portfolio remains sustainable, ensuring that his savings last well beyond 30 years.

Sue also invests R1,000,000, but with a high-fee provider charging 2.5% annually. Unlike Kyle, Sue withdraws R75,000 per year, which is far above sustainable levels. Although her portfolio also earns 10% gross returns, the higher fees and unsustainable drawdowns quickly eat into her investment.

After fees and inflation, Sue’s net return drops to 2.5%. However, with her aggressive withdrawals, the combined effect of drawdowns, inflation, and fees totals 7.5% annually – well above the net growth rate. As a result, Sue’s portfolio starts to shrink from day one, and she risks depleting her savings within 15-20 years.

As you can see, even small differences in fees and drawdown strategies can have a significant impact on retirement outcomes. With low fees and sustainable drawdowns, more of the investment stays invested and can compound. Meanwhile, high fees combined with unsustainable withdrawals create a risky situation that can quickly drain your savings.

By implementing the Golden Equation formula and making sure that fees, inflation, and withdrawals don’t outpace your returns, you can secure your financial future and enjoy a steady income without the fear of outliving your savings.

You can read more about the golden equation and adjusting your drawdown rates here.

Managing Market Volatility And Inflation

While you may be tempted to increase your drawdown rate in order to receive a larger income, it’s important to consistently review your asset allocation to ensure your drawdowns remain sustainable. During market downturns like recessions and other economic tough times, the most important thing is to adjust your withdrawals accordingly to make sure you don’t deplete your capital.

Inflation erodes purchasing power over time, which is why it’s crucial to invest in assets that can outpace inflation. In other words, long-term growth assets that can counteract inflation’s impact. Staying invested in growth assets during market downturns can then be a wise strategy – depending on your individual situation, of course.

Growth asset classes such as equities can help you to recover during market upswings. The idea is that, over time, when the market recovers as it tends to do, those investments will likely bounce back and increase in value again. Staying the course, if you’re able, is fundamental.

Maintaining the balance between what you earn from your fund and what you take from it is the key to preserving your ideal lifestyle after retirement. This balance is also something that 10X Investments is well-versed in. We have years of experience navigating market fluctuations, downturns, and times of growth, helping our clients maintain a critical balance so they can get the most out of their retirement and their hard-earned savings.

In addition, our funds are diversified by design, helping to mitigate inflation by providing a relevant asset allocation for your timeline and risk profile. This ensures our clients' purchasing power is protected over time.

Asset Allocation For Growth And Diversification

As mentioned earlier, a diversified approach to asset allocation would be to spread your investments across different asset classes and regions, thus reducing risk. To this end, 10X Investments offers a range of funds designed to meet various financial objectives and levels of risk tolerance:

10X Your Future Fund: Provides a diversified blend of stocks, bonds, and property across local and global markets. This fund is ideal for long-term investors aiming for capital growth with a balanced risk approach.

10X International High Equity Fund: Focuses on international equities, ideal for those seeking higher returns over 7+ years. Although this fund carries more volatility, it offers 13.7% annualised returns since inception.

10X Defensive Fund: Allocates more heavily toward bonds and cash, designed for lower risk and steady income over shorter time horizons.

10X Medium Equity Fund: A balanced mix of equities and bonds, suitable for those seeking moderate growth over 5+ years.

10X Money Market Fund: Focuses on capital preservation, offering low-risk, short-term investments with 6.6% annual returns since inception.

You can learn more about diversified asset allocation here.

The Role Of Offshore Investments In Capital Growth

As mentioned, our 10X Your Future Fund is diversified across both local and international assets (and if you are invested in a living annuity, you can choose to have up to 100% of your investment offshore). We do this to hedge against country-specific risk and offer our clients access to international markets. Just as diversifying across asset classes helps balance risk and growth, the same is true for diversifying your assets geographically.

Offshore investments help retirees diversify away from the risks of the local market, for example, political instability or economic downturns. This means that while your investments may be struggling in the domestic market, your risk is balanced due to healthier returns in your investments overseas. This is referred to as global exposure, and it can help retirees increase the likelihood of capturing growth from different regions, industries, and currencies.

Offshore investments can also offer retirees protection against weakening local currencies. If the Rand is suffering but the Dollar is doing well, and you have investments in both currencies, you may be able to offset the low returns of one with the healthy returns of the other.

It’s important to note, however, that no offshore investment is risk-free, as all currencies are still inherently volatile. A strong dollar boosts the value of offshore investments when converted back to rands, resulting in higher gains – but if the dollar weakens and the rand strengthens, those same investments can lose value in rand terms, even if the assets perform well in their local market.

This is something of a double-edged sword. Currency movements can amplify gains, but they can also increase losses, adding an extra layer of risk to international investments. This is why a blend of both local and offshore investments is often the best way forward when it comes to balancing and managing your risk responsibly. This blend can enhance the overall returns of your living annuity portfolio.

Naturally, we want our clients to have the flexibility they desire, so our living annuity allows for 100% offshore exposure should you request it. But retirees can tailor their investments to suit their preferences, and this process is thoroughly explained by our expert consultants who have many years experience in retirement investments and understand how best to ensure capital preservation and growth.

If you’d like to chat to a 10X consultant, don’t hesitate to get in touch. At 10X, you can expect real assistance from real people – with no call centres, chatbots, or delayed responses wasting your time. Our decades of financial expertise, along with our commitment to transparent, flexible, low fee structures, ensure our clients have enough income to live comfortably while preserving their wealth for the future and the dependents they leave behind.

Reach out to one of our expert consultants today to secure your financial future in retirement, and rest assured; 10X Investments is here to simplify your retirement plan with low fees, an exceptional track record, and a straightforward investment approach.

Related articles

How can we 10X Your Future?

Begin your journey to a secure future with 10X Investments. Explore our range of retirement products designed to help you grow your wealth and achieve financial success.