The Two-Pot Retirement System

18 April 2024

The two-pot retirement system is part of the government’s overall retirement reform program set to improve the retirement outcomes for all South Africans. The long-term goal of a retirement fund is to prioritise saving towards retirement, but the reform program allows members to access the saving portion of their retirement benefit only for unexpected expenses and during financial distress.

Things to keep in mind

- You can only access your money from your savings pot, once every tax year.

- Any amount saved in a retirement fund will be split into a savings component and a retirement component.

- One-third automatically goes into the savings component and two-thirds into the retirement component.

- The funds in the savings component should only be used in case of an emergency, such as a medical emergency or natural disaster.

- The money you withdraw from the savings pot will be added to your taxable income and taxed at your marginal tax rate – and for some high earners, you are looking at being taxed 45%.

Below you will find access to 10X brochures on the new two-pot retirement legislation coming into effect later this year. You'll also find some frequently asked questions that we hope will clarify the effect of the new system on our clients.

What does the two-pot retirement system mean for you?

Frequently Asked Questions

What is the two-pot retirement system?

The two-pot retirement system allows you to access funds allocated in a savings component and a retirement component, referred to as “pots”. The savings component is intended for unexpected emergencies that would include family emergencies, medical emergencies, urgent home repairs, legal issues and natural disasters. The retirement component is an “untouchable” component specifically created for preservation until retirement.

Why was the two-pot retirement system implemented?

Since only 6% of South Africans can retire comfortably, the two-pot retirement system was created to alleviate financial stress by introducing improvements to retirement savings preservation as it provides a level of flexibility to accessing retirement savings when emergencies arise.

Who is the two-pot retirement system meant for?

The new system will apply to all retirement funds, that is, both private sector and public sector funds except for legacy retirement annuity policies, or funds with no active participating members. Pensioners and members of provident funds who were 55 years and older on 1 March 2021 who have not opted to be part of the two-pot system will also be excluded.

How does it work?

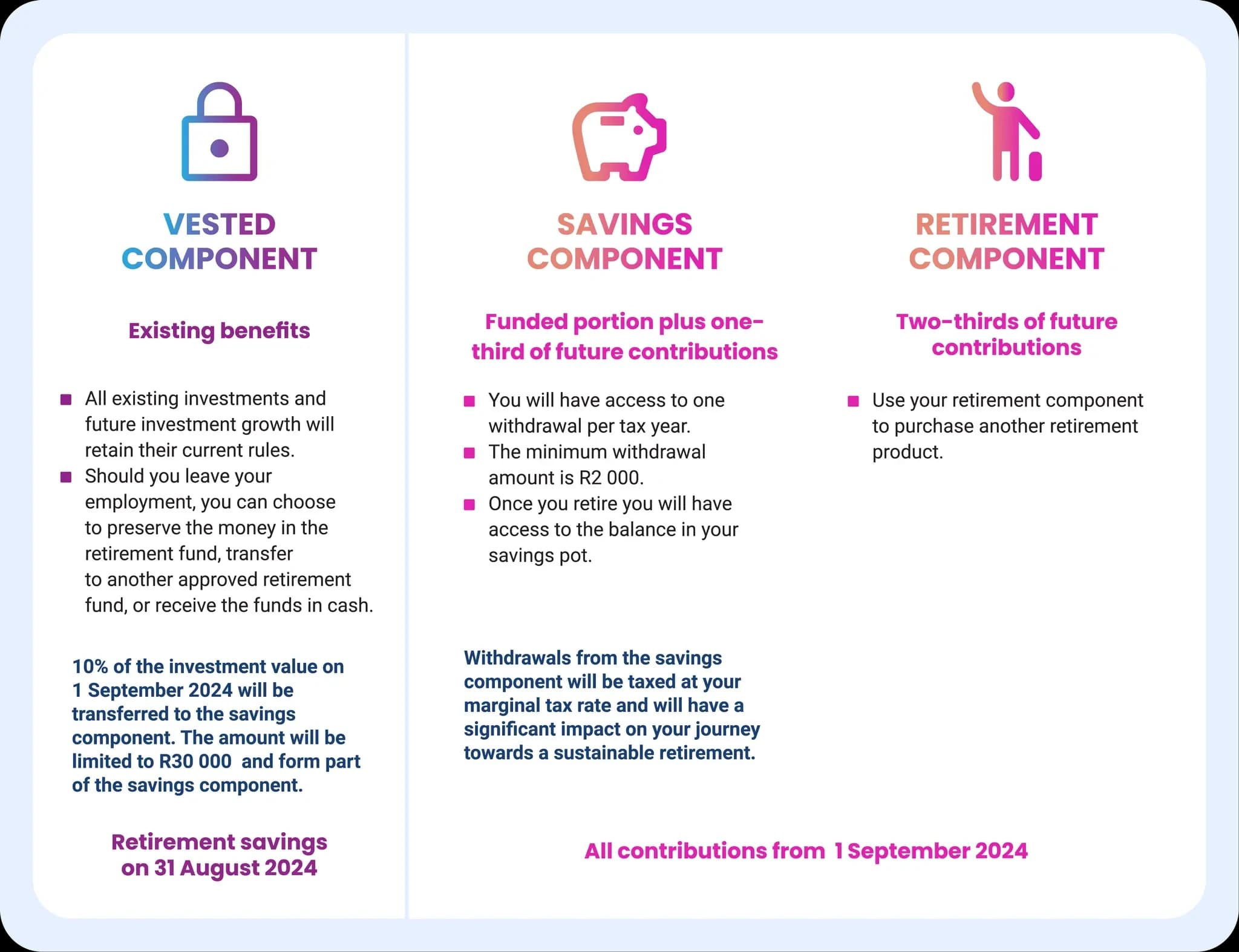

On 1 September 2024, two new components (also known as pots) will be created, a savings component (pot) and a retirement component. Your existing retirement savings will be retained in the vested component and remain invested for continued growth.

Once the components are created, a once-off seeded event will take place and 10% of your existing benefit (vested component) will be transferred to your savings component. If this amounts to more than R30,000, only R30,000 will be transferred as seed capital.

All contributions received from end September 2024 will be start being split 1/3 into savings component and 2/3 into retirement component.

Will I have to pay any administration fee to access money from the savings pot?

If you withdraw from your savings pot, you will have to pay an administration fee for every withdrawal you make from the savings pot. The administration fee will be R300 (excl. VAT) and will be deducted before applying for tax.

You can use our two-pot calculator to help you with your withdrawal calculations.

Will age be a factor in accessing my funds?

Yes, if you belonged to a Provident Fund or a Preservation Fund, remained in the same fund, and were 55 or older as of 1 March 2021, you are automatically opted out of the two-pot system. You will have the opportunity to opt in but ONLY for 1 year, until 1 September 2025.

Your options are:

- To continue to contribute to the vested component (until you retire or leave the fund) or

- To participate in the two-pot system and split all new contributions between savings and retirement components. You will then no longer be able to contribute to the vested component.

If you were over the age of 55 years on 1 March 2021 and became a member of the Provident or Preservation Fund after 1 March 2021, you are automatically opted in.

Pension Fund members and Retirement Fund members are automatically opted in, regardless of age.

Can I access my money in the savings component from 1 September 2024?

Legislation allows you to access your money from your savings pot, however, keep in mind:

- You can only do one withdrawal per tax year, i.e. 1 March to 28 February.

- The minimum amount is R2 000.

- The savings withdrawal is subject to marginal income tax.

- The savings withdrawal is subject to an administration fee.

- Your vested component will provide initial capital for your savings component of 10% of your fund balance on 31 August 2024, capped at R30 000, and will be allocated to your savings component. You need a balance of at least R2 000 before you can make a withdrawal.

Thinking of withdrawing? You can use our two-pot calculator to help with your calculations.

What happens to my funds should I die?

Your beneficiaries will be able to access the benefits in all three components as either a cash lump sum retirement benefit or a compulsory annuity or a combination of both.

What will happen when you retire after the two-pot retirement system is implemented?

At retirement, you will have access to the 3 different components:

Vested component: This component could consist of both a vested and a non-vested portion due to T-day rules. Options are as follows:

- Non-Vested: 1/3 can be taken in cash and 2/3 must be used to purchase an annuity for regular income.

- Vested: 100% can be taken in cash or used to purchase an annuity for regular income.

Savings component: members can take up to 100% cash or purchase an annuity for regular income.

Retirement component: 100% of the capital in the retirement pot must be used to purchase an annuity for regular income.

Brochures

To find out more about the two-pot retirement system, read the 10X brochure:

- 10X Investments Two-pot retirement brochure in English

- 10X Investments Two-pot retirement brochure in Afrikaans

- 10X Investments Two-pot retirement brochure in Xhosa

- 10X Investments Two-pot retirement brochure in Zulu

How can we 10X Your Future?

Begin your journey to a secure future with 10X Investments. Explore our range of retirement products designed to help you grow your wealth and achieve financial success.