3 top money tips from savvy retirees

4 July 2024

At 10X, we’ve been helping thousands of South Africans retire better for over a decade. And it might surprise you to learn that it isn’t magic, really good luck or using the right fortune-teller that determines the comfortable retirement you deserve. Rather, common sense, being honest about the phase of life you are moving into and a good understanding of the principles involved in retirement investment are all that it takes (of course, saving for retirement also helps, and it’s never too late to get started).

Whether you’re retired, looking to retire soon or simply thinking about the best way to plan for your life-after-work, these tips from people who also faced the decisions you’re facing should help you get the peace of mind you need to make the best decisions for your future.

Joggie Mentz: Choosing the right retirement investment

When you retire (the minimum age for which in South Africa is 55) you need to use at least two-thirds of your retirement savings (pension or provident fund, preservation fund, or retirement annuity) to purchase either a guaranteed annuity or a living annuity. 10X client Joggie Mentz chose a living annuity because of the flexibility it offered in terms of income and investment, and because he could leave any capital in the living annuity to his beneficiaries when he passed away.

Let’s take a quick look at the difference between a living annuity and a guaranteed annuity.

- A living annuity is an investment product where retirement savings are invested in assets and the returns on those investments pays you an income in retirement.

- A guaranteed annuity (sometimes referred to as a life annuity) on the other hand, is an insurance product where you hand over your retirement savings capital to an insurer, and they pay you a fixed income until you pass away.

A living annuity puts you in control of your retirement investments. You can choose your investment portfolio (i.e. the underlying assets into which your retirement savings are invested), the level of income you want to draw from the investments, and if you are dissatisfied with your provider, you can take your money elsewhere. Importantly for Joggie, your nominated beneficiaries inherit whatever is left of your capital after your death.

Plan for a comfortable retirement with our

Living Annuity calculatorA guaranteed annuity means that an insurer assumes any risks to do with your investment. It insures you against longevity risk (the risk that you outlive your savings) as well as investment risk (depleting your capital too soon due to inadequate investment returns). But, you don’t have any control over how your money is invested, nor how much income you draw. Also, your policy dies with you, and no money passes to your heirs.

You can split your investment savings between a living annuity and a guaranteed annuity. You can also switch from a living annuity to a guaranteed annuity, but not the other way around. This is one of the reasons you might want to have multiple living annuities, which is perfectly legal: at some point, you might want to move some of your retirement capital into a guaranteed annuity, but not all of it. You might choose to have more than one living annuity to give you this flexibility, as you cannot take a portion of a living annuity and convert it - you must convert the entire fund. If you have any further questions concerning a living annuity, check out our Living Annuity FAQ page.

Sarah-Jane Wagg: Review performance and fee structure to maximise your money

When 10X client Sarah-Jane Wagg looked at how her previous investment provider was (or wasn’t!) growing her investment, and what she was paying for this lack of growth, she made the move to 10X. “There is a lot of overcharging by asset managers,” says Sarah-Jane, “you want to look for those asset managers that have performance and lower charges because you then get more of your money going back into your pension fund and growing for your retirement.”

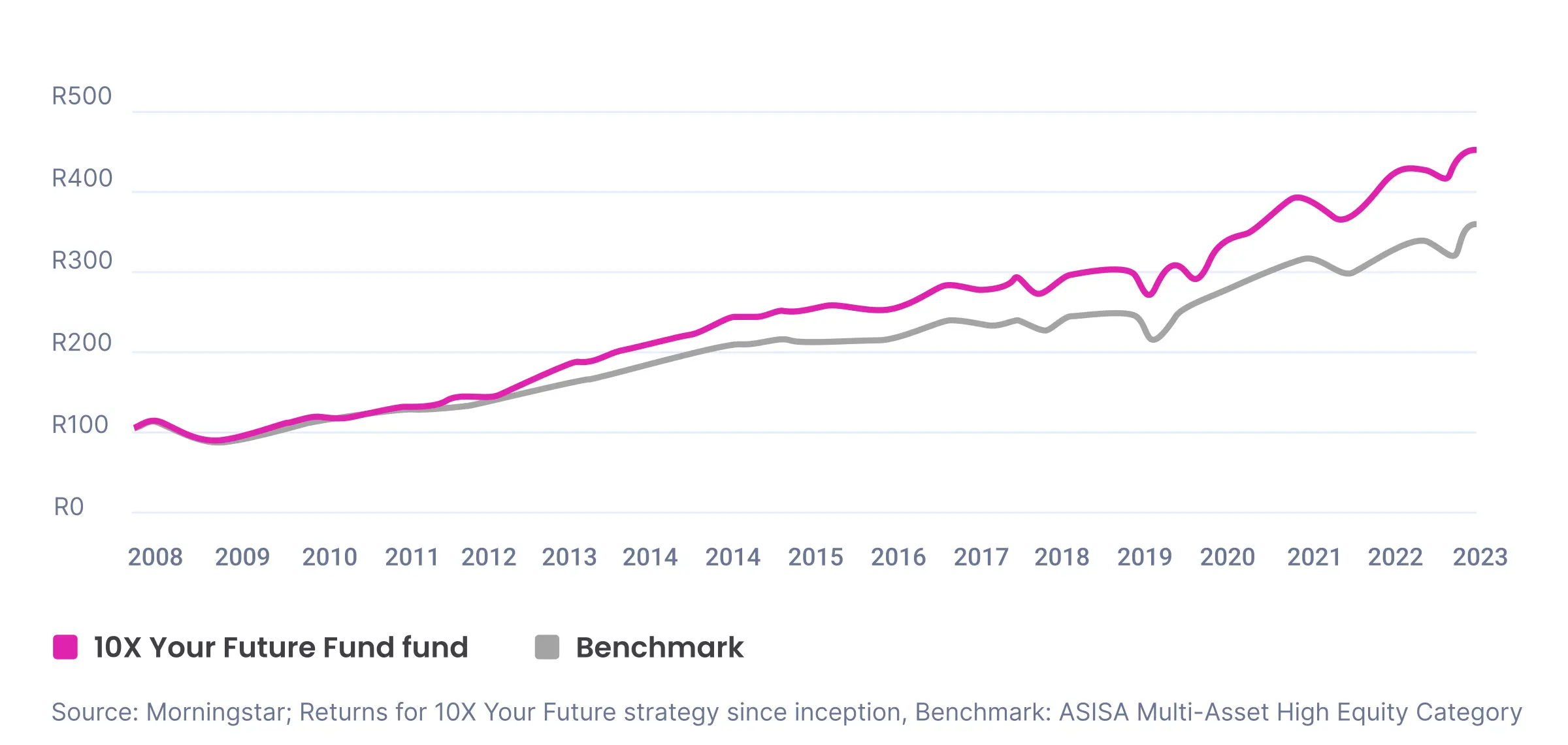

At 10X, we’re proud of our 100% multi-asset benchmark index outperformance record (that’s a mouthful - it just means we’ve done better than most of our peers on a consistent basis). The 10X Your Future fund has annualised returns of 12.1% since inception, and when you take into account the fact that our fees start at 0.86% and only get smaller the more you invest, you can see why Sarah-Jane saw us as an attractive option for her retirement savings. You too could likely be doing better if your money was invested with 10X - but don’t take our word for it. Do a completely free cost comparison and see for yourself.

9 out of 10 people do better with 10X

Bob Bond: Be prepared and make provisions for your life-after-work

“When you look how changeable the world is,” says 10X client Bob Bond, “with coronavirus and the economic situation in South Africa, one has to be prepared, something could happen tomorrow.”

Andre Tuck, Senior Retirement Consultant at 10X echoes Bob’s words: “One of the biggest mistakes we see retirees making is underestimating the costs (such as healthcare) they might incur during their retirement.” According to Statistics SA, most causes of death in South Africa are attributed to non-communicable diseases, such as stroke or heart disease, manifesting mostly in older people. If you don’t provide sufficiently for healthcare, your retirement could become a costly and stressful exercise in paying off medical bills.

Another factor to consider is that as a retiree you might find yourself looking for ways to fill your time. The cost of hobbies – such as travel, eating out, sports and other entertainment – can really add up. The reality is that retirees tend to need more money in their retirement than they think. Our data suggests the figure is somewhere between 70-80% of their pre-retirement income. Creating a detailed and realistic budget to help you manage your money and plan for unexpected expenses is therefore a great way to give yourself peace of mind.

How can we 10X Your Future?

Begin your journey to a secure future with 10X Investments. Explore our range of retirement products designed to help you grow your wealth and achieve financial success.