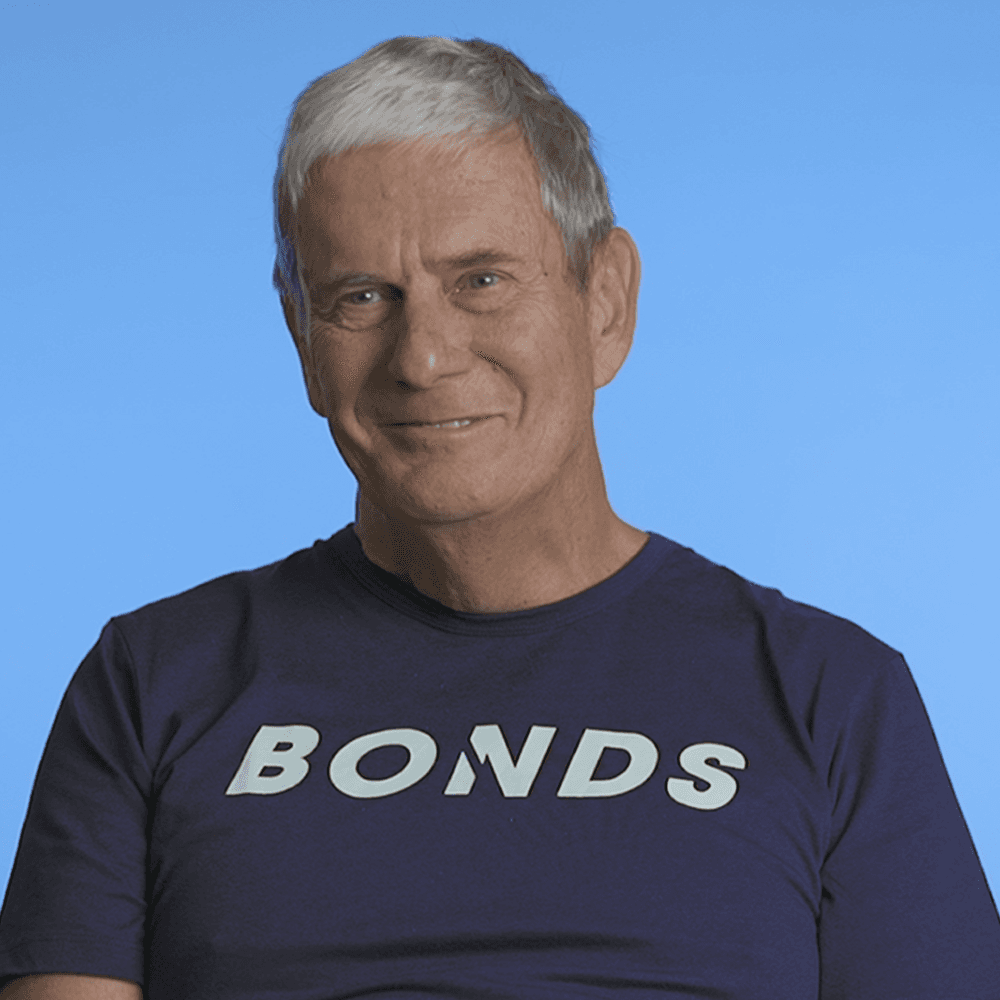

testimonial

Why give that money to the taxman?

Robert James Bond, aka Bob, has been saving for retirement since he was 18, taking advantage of the tax benefits right from the start of his working career. He says: “If you are not doing that you are crazy.”

His advice to younger people, including his four adult children, is to start retirement planning very early “as soon as you start earning a salary”.

Use 10X Investments’ online retirement calculators to see how much more money you could have when you retire.“If nothing else,” he urges, “take advantage of the tax benefits.”

Bob is referring to the tax incentives on saving for retirement. Money that you put into a retirement savings fund is deducted from your taxable income, so the more you save the less tax you pay. If, for example, you earn R500,000 a year, and contribute R50,000 to a retirement savings fund, you pay tax on only R450,000. (This is to illustrate the principle only – in reality, your tax calculation will probably include other tax deductions.)Bob says: “Why give that to the taxman. Use the money for other purposes. It could actually be in your pocket.”

In addition to diverting some of their taxes into their own retirement fund for many decades, early starters will benefit from compounding, the near-magical force that grows your money faster and faster over time.

Tax incentives and compounding aside, Bob has always thought it was important to save for retirement. “There is no safety net in South Africa, you really need to make provision for your old age.”

He adds: “When you are young, retirement is 45 years away, but I can guarantee you time tends to speed up exponentially once you are over 30, 40, 50 … My major advice is start early and then constantly monitor the performance of your portfolio.”

This is where, Bob says, 10X is “outstanding” because you can monitor performance electronically, even on a daily basis, should you so wish.

“And then,” he adds, “you have access to specialists behind the scenes to deliver these calculations that you need to do so that you can time your retirement correctly.”

In his early sixties now, Bob reckons retirement day could be any time. “If you look at how changeable the world is, Coronavirus, the economic situation in South Africa. I think one has to be prepared, it could happen tomorrow.”

Fortunately, he has saved steadily since he started working and is in a position that he “could retire at any time”.

Bob says he started on the journey of saving for his pension with a traditional company, “long before 10X”. In the past 3-5 years, when retirement started to come into view on the horizon, Bob says, he started to look more closely at investment performance.

At that stage, he realised that he had “paid a lot of money for not a great return” and started looking for an alternative. That was when he came across 10X and quickly moved a large part of his portfolio across.

Bob says he has been happy with the performance and it is clear to him how lower fees have increased the value of his investment.

In addition to that, Bob says his experience of switching to 10X was a “refreshing surprise”.

“While I was sceptical initially, I found the experience very pleasant, getting my first policy, making changes when I needed to make changes, and having access to qualified people.

“At 10X, I experienced very high-level people, who gave me all the info I was looking for. In fact, they exceeded my expectations.”

He concludes: “I think it is refreshing to deal with companies like 10X, they are establishing a new benchmark in terms of how to be client-focused.”

The views expressed in this interview are Bob's opinion, based on his personal experience, and should not be construed as financial or tax advice. Bob Bond was not paid for this interview although 10X compensated him for time spent and expenses incurred on the day.

How can we 10X Your Future?

Begin your journey to a secure future with 10X Investments. Explore our range of retirement products designed to help you grow your wealth and achieve financial success.