Preservation funds and the power of compound growth

20 October 2025

The uncomfortable truth about retirement in South Africa - Rands and Sense by 10X [video]

We sit down with 10X Investment Consultant lead Andre Tuck and discuss the retirement savings crisis in South Africa. We also delve into living annuities, retirement annuities, TFSAs and everything in between. Read more

![The uncomfortable truth about retirement in South Africa - Rands and Sense by 10X [video]](/_next/image?url=https%3A%2F%2Fimages.ctfassets.net%2Fyqvz0zwovkbq%2F5ipSTnRq5Dp25fyghm5kGQ%2F02c801c78d5e1ca9280bfd34d7602368%2FAndre_Tuck_podcast_cover_image__1_.webp&w=828&q=75)

A preservation fund is a retirement savings vehicle that allows you to transfer savings from an employer-sponsored pension or provident fund when changing jobs. This transfer happens without triggering a tax event and allows for your savings to be invested, which means it may continue to grow. The importance of compound growth in this regard should not be understated.

This is the growth that occurs not only on your initial investment but also on the subsequent returns that are made. This growth is especially important when it comes to preservation funds, as these do not receive any additional contributions. As such, growth is more a function of fund performance and fees, assuming you don’t withdraw anything. In this article, we will investigate compound growth in more detail, covering everything that you need to know.

See your pension savings grow with our

Preservation Fund calculatorUnderstanding preservation fund compound growth

Compound growth is a powerful tool for an investor, as it has the potential to boost the long-term growth of your preservation fund. Returns that are generated by your preservation fund are reinvested, and there is further growth generated on both the initial amount and the returns made.

This process happens each year that your savings remain invested, resulting in a snowball effect. This exponential effect leads to your investment growing faster and faster, simply because you’ve stayed invested.

As you can imagine, the earlier the savings are invested and the greater the returns that are generated, the greater the compounding effect and the more your preservation fund will grow. By taking advantage of compound growth, you can get the most out of your preservation fund performance and set yourself up for retirement.

We've built the 'happy retirement' machine

Understanding the most effective strategy for investing your retirement savings is fundamental to experiencing a happy retirement. We've built an investment machine that gives you a great chance of really golden years. Read more

Why preservation funds are perfect for compounding

Preservation funds are long-term retirement savings vehicles, which means that your savings will be invested for a significant period of time, allowing for more potential compound growth to occur. The savings from your pension or provident fund are invested in the preservation fund to help ‘preserve’ and grow them, so that they may provide for your retirement years in the form of an annuity.

The growth within the fund is not taxed, meaning that there are potentially more returns to be invested and allowed to compound over time. Your savings should remain invested in your preservation fund, and if possible, there should not be any withdrawals, as you cannot make any additional contributions. As previously stated, this means there is more capital available to generate returns and compound over the long term.

The Two-Pot Retirement System

All investors should also be aware of the new rules regarding withdrawals, which were implemented in September 2024 with the Two Pot Retirement System. All contributions will now be split between two ‘pots’: the ‘retirement pot’ and the ‘savings pot’, with two-thirds going to the retirement portion and one-third going to the savings portion. This is, however, not applicable to preservation funds, as there will not be any further contributions added.

Two-pot cheat sheet

This cheat sheet has all the information you need to know about the two-pot retirement system and what happens if you want to withdraw. Read more

There is also a third portion called the ‘vested pot’. This pot is for all of your savings accumulated before the system’s introduction. This pot is governed by the old rules that were in place before September 2024. As such, you are allowed one withdrawal from the vested pot before retirement.

The savings component of the preservation fund will actually grow at the same rate as the total fund. If the total fund grows by double its size, both the savings pot and the vested pot will also grow by double their size. You can withdraw from your savings pot once per year for a minimum amount of R2,000. These withdrawals are taxed at your marginal tax rate, and an administration fee will be applied.

The retirement pot is where the bulk of your savings goes, and is reserved exclusively for use at retirement, where you will need to purchase a retirement product like a living annuity or life annuity. Retirement age in South Africa is currently set at age 55. Please consult the latest FSCA guidance on the Two-Pot Retirement System.

The role of time in compounding

The earlier that you start saving, the more opportunity there is to take advantage of compound interest and growth. Let’s look at a straightforward example to illustrate the power of compounding:

Scenario 1: In the first scenario (late start), you start with an R1M lump sum and generate 6% real return (i.e., after fees and inflation) over 10 years.

Scenario 2: In the second scenario, you also start with an R1M lump sum, but 20 years earlier. In other words, the savings remain invested for a total of 30 years with the same 6% real return.

In Scenario 1, you end up with roughly R1.73M

In Scenario 2, you end up with roughly R5.22M

As we can see with this example, the power of compound growth is clearly evident, highlighting the powerful impact of keeping your savings invested over a longer period of time.

The role of asset allocation and returns

As your preservation fund doesn’t receive contributions, you’ll have to be strategic when it comes to your asset allocation. As an investor, you need to have a clear understanding of asset allocation, so you can align your investments with your retirement goals. Asset allocation plays the biggest role in the performance of your preservation fund, accounting for over 90% of returns, as seminal research from Brinson, Singer and Beebower shows.

At 10X, we have a selection of carefully chosen funds that each have a different asset allocation, allowing you as the investor to choose a fund that best fits with your investor profile, investment timelines, and long-term financial goals. Please visit our funds page for the most up-to-date information.

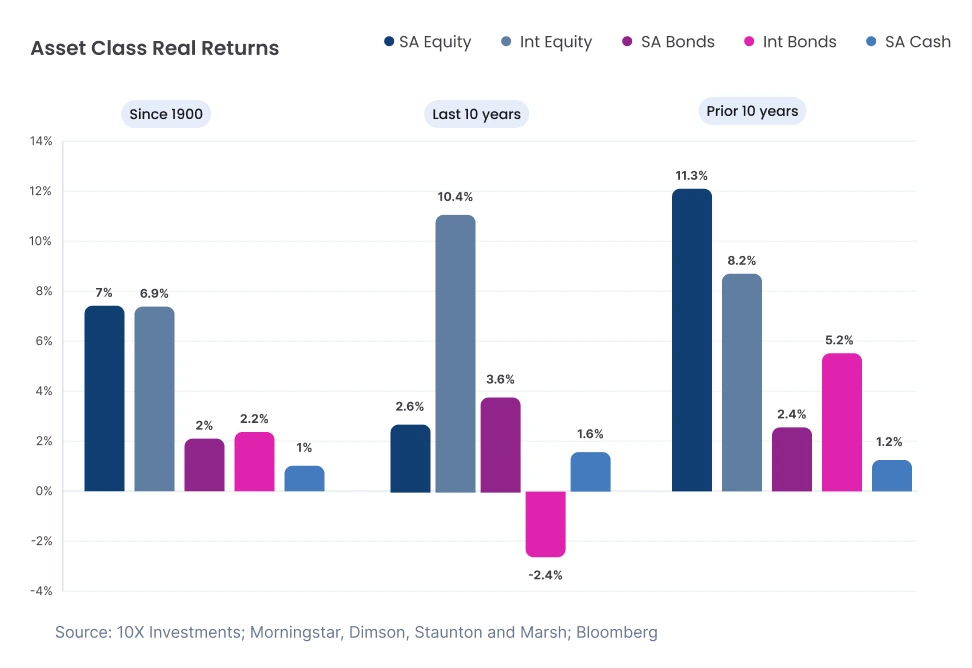

Your asset allocation is a mix of the different asset classes. These include equities, bonds, real estate or property, and cash. Equities are considered the most volatile of the asset classes, but they are also the most likely to generate the best returns over time. Equities have historically produced returns above inflation, by around 7% annually over the long term (based on JSE All Share Index performance versus CPI from 1960-2020); however, past performance does not guarantee future results.

Bonds are more stable than equities but are also likely to generate lower returns. Real estate can provide a good hedge against inflation, but it may also be quite volatile. Cash is the most stable and liquid of the asset classes, but likely to generate the lowest returns of all the asset classes. Generally, you would look to include some equities in your portfolio while making sure this aligns with your risk tolerance levels, timelines and financial goals.

Diversifying across the asset classes allows you to potentially balance both risk and reward by ensuring you are not too heavily invested in any of the asset classes. You may also consider further diversifying your portfolio by investing offshore, as this can also provide a hedge against any local market instability and subsequent depreciation of the rand. Offshore investing may also offer access to a wider range of industries and companies than what is available in the smaller South African market.

9 out of 10 people do better with 10X

When looking to diversify your preservation fund offshore, Regulation 28 must be kept in mind. Preservation funds, along with all retirement products, are subject to Regulation 28 of the Pension Funds Act. This regulation was implemented to help investors structure a well-diversified portfolio. Current regulations put a limit on the percentage of your retirement annuity that you may invest in both equities and offshore. This limit is currently sitting at 45% for offshore investments and 75% allocation to equities.

The enemy of compounding: Fees

We often find that investors fail to fully realise the impact that fees may have on the potential growth of the fund itself. High fees may reduce the returns that you have available to reinvest and compound over time. Conversely, lower fees may mean that you have more fees available to reinvest and compound over the long term. As an investor, you need to stay fully aware of the fees that you are paying on your preservation fund and, if possible, try to minimise said fees.

The fees that you can expect to see deducted are as follows:

Advisor fees: Your advisor will charge fees for the financial service and guidance. You may see both an initial and an ongoing fee charged.

Administration fees: These are the fees that are charged for the administration of the fund. This could be for tasks such as reporting, tax and similar.

Management fees: The fees that are charged for the management of the fund.

Other fees: There may be other fees applicable to certain products, such as exit fees.

Let’s look at an example to illustrate the effect of fees on your preservation fund. We will compare fees of 3% with fees of 1%. We’ll assume the following factors for the purpose of the example:

- Investment period of 30 years

- Investment of R100,000

- Return of 12% per annum

- An inflation rate of 6%

- Example 1 (1% Fees): Real investment value is R398,578.

- Example 2 (3% Fees): Real investment value is R231,004.

We can clearly see how high fees impact your fund’s growth. Note that this example is for illustrative purposes only, and real results may vary. You can learn more about the importance of fees here.

The Effective Annual Cost (EAC) of your preservation fund should be reviewed regularly. This is a standardised metric that ASISA introduced in 2015. All factors being equal, a higher EAC may mean that there are fewer returns available to be reinvested and allowed to potentially compound over time. On the other hand, a lower EAC may mean that there are more returns available to potentially grow and compound over time.

When considering different service providers, the EAC would be just one factor to consider. 10X offers a free EAC calculator as part of our online suite of tools. This calculator lets you compare the EAC charged by 10X with the EAC of your current service provider.

At 10X, we are able to offer a range of cost-effective and transparent investment options for our clients, all with a focus on obtaining excellent long-term results. Our fees on most retirement products are less than 1%, depending on the selected product and the amount which is invested. Our index tracking investment structure, alongside a more active approach to asset allocation, helps to keep our fees on the lower end of the scale.

How to maximise the power of compounding in your preservation fund

The key to getting the most out of your preservation lies in time, consistency and smart investment choices. Consider these practical tips to improve your fund’s long-term growth potential.

- Keep costs low: Fees directly reduce your investment returns, which means they also reduce the amount available to compound over time. Even small differences in annual fees can have a huge impact over decades. You can always transfer to a low-cost provider without disrupting investment growth.

- Maintain an appropriate asset allocation: Asset allocation drives most of your long-term returns. To fully harness the power of compound growth, you should consider a fund including growth assets, such as equities, which historically provide higher returns over the long term.

- Avoid withdrawals: Remember, you can’t make any more contributions to your preservation fund, and early withdrawals reduce the capital base on which compounding can work. Compound growth rewards patience.

- Avoid emotional decisions: Markets move up and down, and while it is natural to be tempted to react to short-term changes, frequent adjustments can interrupt compounding and lock in losses. While reviewing your preservation fund is important, it’s not always necessary to make changes.

Final thoughts on preservation funds and compound growth

It’s important to remember the power of compound growth. By keeping your savings nvested, avoiding withdrawals and harnessing compound growth, you are able to potentially boost the growth of your preservation fund over the long term.

A preservation fund can be a cornerstone of your long-term financial plan, preserving your hard-earned savings while compounding returns over time and eventually providing you with an income for your retirement years in the form of an annuity. 10X offers a low-cost and transparent preservation fund that allows you to diversify across asset classes. To find out more about the 10X Preservation Fund, get in touch today and secure your future!

Related articles

How can we 10X Your Future?

Begin your journey to a secure future with 10X Investments. Explore our range of retirement products designed to help you grow your wealth and achieve financial success.