Navigating preservation funds during economic downturns

3 June 2025

A preservation fund is a retirement savings vehicle that allows you to transfer savings from a pension or provident fund when leaving employment without triggering tax penalties. If you cash out on these savings, your investment growth ends and you incur taxes, whereas a preservation fund allows for a smooth and tax-free transfer to a provider who then invests these funds on your behalf. They help you, as an investor, keep your retirement savings on track despite leaving a job.

See your pension savings grow with our

Preservation Fund calculatorThe economic climate can have unanticipated impacts on your retirement planning and goals, as market downturns can reduce the value of your retirement capital, as well as negatively impact any income you may be drawing in your retirement years. You’ll need to regularly review and adjust your retirement savings vehicles to cater for volatile market conditions in an effort to optimise your retirement investments.

This article looks at how to mitigate the effect of volatile markets on your preservation fund and how to ride out these times for a potentially positive outcome. At 10x, we have a track record of superior returns, low fees, and a fully transparent approach to investing.

An introduction to investments in South Africa [video] - Rands and Sense by 10X

Want to know about offshore investing, property as an asset class, tax-free savings accounts and everything in between? Rands and Sense by 10X is here to help you understand investment fundamentals. Read more

![An introduction to investments in South Africa [video] - Rands and Sense by 10X](/_next/image?url=https%3A%2F%2Fimages.ctfassets.net%2Fyqvz0zwovkbq%2F7qzuglRSuERVXYEw569szC%2Ffd490209f27286680c8f3916f8aac2a0%2FRands___Sense_Podcast_-_Episode_1-2.webp&w=828&q=75)

Preservation fund rules and legislation

By transferring your savings to a preservation fund, you can potentially compound the returns and grow the capital over time. In other words, allowing your retirement savings to remain invested as had been the case in your pension or provident fund. The savings can be transferred from the pension or provident fund to the preservation fund without triggering any tax penalties. If possible, it’s generally best to avoid the temptation of withdrawing funds when leaving an employer and instead keep the funds invested, as this allows savings to potentially grow, and you do not lose out on the compound interest that would have been generated by the capital which you withdrew.

Retirement Annuity vs Tax-free Savings Account vs Bond: Where Should Your Extra Money Go?

Got extra money to invest? Compare three powerful options: Retirement Annuity, Tax-Free Savings Account (TFSA), or paying off your bond faster. Learn the pros and cons of each to make an informed choice for your financial future. Read more

The rules regarding withdrawals from retirement savings vehicles, including preservation funds, have changed with the implementation of the new Two Pot Retirement System in September 2024. This system splits all contributions between 2 pots, namely the ‘retirement pot’ and the ‘savings pot’.

The retirement pot is to remain invested until retirement age, when it can then be transferred to a living annuity or life annuity. The bulk of your savings goes into this pot, and it is reserved exclusively for use at retirement for purchasing a retirement product.

The savings pot can be accessed once per year, for a minimum amount of R2000. Withdrawals are taxed at your marginal rate and are subject to an administration fee. This should only be considered in emergencies, as keeping the savings invested allows them to potentially compound and grow over time.

There is also a third pot called the vested pot that is still governed by the rules before September 2024. These are your savings accumulated before the new system's introduction. The vested pot allows for one withdrawal before retirement, which is taxed according to the lump sum withdrawal tax tables. Please consult the latest FSCA guidance for the most up-to-date information on the Two Pot Retirement System.

10X offers a low-cost preservation fund with access to a variety of different funds inside the preservation fund wrapper. To find out more, follow this link.

Investment risk in an economic downturn

While economic downturns form a regular part of a market’s cycle, they can be nerve-racking for anyone trying to save for retirement or drawing income in retirement.

Market volatility

In an economic downturn, equity markets become more volatile and asset values decline. Such market volatility can affect the value of the capital in your preservation fund. While some may panic and see this as the time to withdraw, it’s important to remember that this is a long-term investment, and withdrawing during downturns can potentially lock in losses.

By keeping the funds invested, you have an opportunity to recover any losses as the market itself recovers. As an investor, you should try to avoid any emotional reactions and knee-jerk decisions. Volatility and market downturns are part of the investment cycle and something which needs to be taken in your stride as an investor, despite how distressing they may be.

Interest rate changes

During an economic downturn, the South African Reserve Bank may adjust interest rates to support the economy. Such rate changes can have an impact on the performance of bonds and or other fixed-income instruments in your preservation fund, highlighting the importance of strategic asset allocation.

Currency changes

In an economic downturn, you may see the rand weaken. If you have investments with offshore exposure, you may actually end up benefiting. But the converse could also be true if international markets are suffering. Again, we can see the importance of diversification of local and international assets to potentially protect and grow your savings.

Inflation and your investments

Inflation erodes the purchasing power of our money over time. This means that with a nominal sum of money, the bag of goods and services that we are able to purchase will be smaller each year. The same applies to the purchasing power of your preservation fund capital. If your preservation fund is not matching or beating the inflation rate, this may result in a reduction in the real value of your preservation fund capital, even if the whole number is growing.

By diversifying your portfolio across a variety of asset classes, you can take advantage of any potential gains in certain asset classes, as well as mitigate against any losses in other asset classes. A well-diversified investment aims for growth as well as protection against inflation, striking a balance between risk and stability.

Asset allocation: The key to long-term growth and risk management

We can see that asset allocation plays a major role in getting the most out of your preservation fund, particularly during economic downturns. At 10X, you have the freedom to customise your underlying investment portfolio by choosing from a selection of carefully curated investment funds. These funds give you the freedom to diversify across various asset classes like equities, property, bonds and even offshore investments.

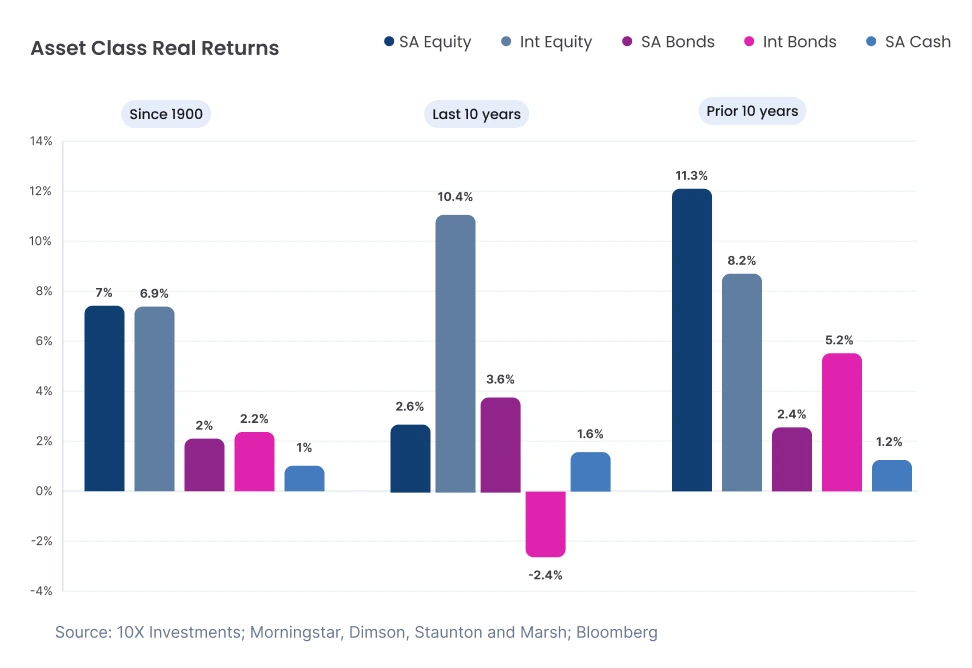

Depending on your risk profile and the timelines at play, you can choose a fund that best suits your needs. Equities are more volatile but may have the potential to produce the best returns over the long term. Bonds may provide some stability to your portfolio, but may produce lower returns. Cash also adds stability, but will most likely produce the lowest returns of all. Real estate may be a good hedge against inflation.

For investors with a higher risk tolerance, you may want to choose a fund with a greater allocation towards equities, while those with a lower risk tolerance might prefer a higher allocation towards bonds. By diversifying across multiple asset classes, you can potentially benefit from different economic cycles.

During volatile times, you may find that equities lose value quickly, but they also have the potential to recover quickly. On the other hand, bonds and cash may add stability during a market downturn, which may add some protection. Including offshore exposure can also protect your investment funds from local market volatility and currency fluctuations, while providing for potential growth opportunities which could be available in the international market.

During times of volatility, you should consider assessing your portfolio and asset allocation to make sure that it is still meeting your financial goals and needs, as well as remaining suitable for the current market conditions.

10X offers a variety of carefully picked investment funds which allow you, as an investor, to diversify across the various asset classes while focusing on long-term returns. Asset allocation has been shown to be key to the potential success of a specific fund. The investment consultants at 10X can help you understand the facts about your choice of funds so that you can make the right fund choice to suit your individual needs and requirements.

Investment fees: A hidden risk during market stress

You can expect to see fees charged on your preservation fund, and it’s wise to be aware of and understand the kind of fees you are paying, as fees play an important part in the potential growth of your investment. These fees can be for investment management, administration, advice, and other costs where applicable.

High fees may gradually affect the potential growth of your preservation fund, especially when compounded over the long term. This is because there is less capital to be reinvested, whereas when lower fees are charged, more of the potential returns can be reinvested and compounded over time. The impact of high fees may be even more visible in a market downturn when the market is experiencing lower returns, with higher fees potentially affecting low or negative returns even more. To learn more about how fees can affect returns, follow this link.

The Effective Annual Cost (EAC) is a metric which was implemented in 2015 by ASISA. This metric was established as a way for investors to evaluate all of the costs associated with an investment over a one-year period. The EAC includes all the fees and is comprised of four components, namely: investment management charges, advice charges, administration charges and others. All other factors being equal, a lower EAC means that a greater portion of your investment remains invested and has the potential to generate returns, while a higher EAC can potentially decrease net return as fees accumulate over time. A lower EAC means less of your investment is being consumed by fees. Keep in mind that costs are just one factor to assess when considering investment options.

10X’s EAC calculator is a free online tool provided by 10X to help you evaluate and compare your investment’s EAC.

Let’s look at an example to explain the effect of high fees on your preservation fund. We will be comparing the fees of 3% and 1%.

Let’s assume the following information:

- Investment period of 30 years

- Investment of R100,000

- Return of 12% per annum

- An inflation rate of 6%

Example 1 (1% Fees): Real investment value is approximately R398,500.

Example 2 (3% Fees): Real investment value is approximately R231,000.

This example is for illustrative purposes only, and actual results may vary.

10X offers a transparent and low-fee offering, typically less than 1% for most products, with no hidden costs. To view 10X’s fee structure or find out more, follow this link or speak to one of our knowledgeable and experienced investment consultants.

A summary of mistakes to avoid in an economic downturn

Periods of economic downturn can lead to emotional decision-making, such as wanting to withdraw your funds early. But an important consideration is the long-term effects of potentially locking in losses. You also need to ensure you are aware of all fees you are being charged and make sure to review these fees regularly. Lastly, it’s important to take inflation into account and ensure your portfolio is well-diversified and includes a portion of equities. These are all steps you can take during an economic downturn to help potentially protect your investment’s growth.

Retirement investments and economic downturns

An economic downturn is a normal part of the market cycle, but it can be unsettling, and there are a few things you can keep in mind to put you at ease and help you potentially protect your investments. You should generally try to keep your funds invested during times of economic uncertainty, you should always be aware of the fees that you are being charged, and you should make sure that your asset allocation is meeting your financial goals and taking into consideration the effects of inflation. Remember, a market downturn is a normal part of the investment cycle, and as an investor, the best plan of action is to stick to your financial plan and goals.

At 10X, we have a track record of superior returns, low fees and a straightforward investment approach. To learn more, speak to one of our consultants today.

Related articles

How can we 10X Your Future?

Begin your journey to a secure future with 10X Investments. Explore our range of retirement products designed to help you grow your wealth and achieve financial success.