Maximise Your Retirement Income With A Living Annuity

24 May 2024

A living annuity is an investment product that converts at least two-thirds of your retirement savings into regular income payments once you retire. Living annuities present a popular retirement income option, offering flexibility and adaptability with how you choose to invest and control of your finances upon retirement.

As a leading independent investment manager in South Africa, 10X Investment’s commitment to transparency and provision of expert support empowers our members to maximise their savings. In this brief read, we will cover the ins and outs of living annuities and equip you with everything you need to make well-informed decisions when it comes to investing in your own living annuity.

Understanding Living Annuities

Living annuities are a type of financial product designed to provide you with a regular income stream throughout your retirement. Here’s a breakdown of how a living annuity (LA) works:

1. You invest a lump sum of retirement savings into the LA. If you have a pension or provident fund, pension or provident preservation fund, or retirement annuity fund, you are obligated to use at least two-thirds of your fund proceeds upon retirement to purchase either a living annuity or a life (guaranteed) annuity, given that your fund value exceeds R247 500. The transfer to your living annuity is tax-free.

2. You decide how to invest your funds. Living annuities offer greater investment flexibility, with you as the investor having more control over the investment strategy and allocation of funds within the wide range of investment portfolio options that 10X offers.

3. You decide how you want to receive your income payments. Herein lies a key benefit of living annuities. You have the flexibility to adjust your income withdrawals, between 2.5% and 17.5% of your fund capital. You can choose whether you’d like to receive your income payments monthly, quarterly, semi-annually or annually.

4. The investment in your LA generates tax-free investment returns. While you do not pay tax on your investment growth, you will pay income tax on your withdrawals per standard income tax tables.

The other annuity option mentioned above is a life annuity, which differs from a living annuity primarily in the flexibility of investment choices and income withdrawal available to an investor. Also, the capital amount stays with the company you invested with after your death, whereas with a living annuity that capital can be transferred to a nominated beneficiary. A life (or guaranteed) annuity is a financial product typically offered by insurance companies, rather than an investment product. It is not subject to market movements and pays you a specified monthly pension income for your entire retirement. This differs from a living annuity, in that you will receive a fixed, guaranteed amount of income for the rest of your life without benefitting from investment growth potential or being able to change your income levels according to your needs.

Plan for a comfortable retirement with our

Living Annuity calculatorAs a potential investor considering a living annuity, it’s important to have an understanding of the regulatory framework governing living annuities in South Africa. The oversight of living annuities falls under the jurisdiction of governmental bodies including the Financial Sector Conduct Authority (FSCA), and the South African Revenue Service (SARS).

These bodies seek to protect the interests of retirees and ensure the responsible management of retirement savings by enforcing regulations that govern minimum and maximum drawdown rates (being 2.5% and 17.5% respectively), investment restrictions, taxation of income, and declaration requirements. 10X’s rigid compliance with and transparent communication of these legislative frameworks helps to ensure that you, as the annuitant, can enjoy your retirement savings while adhering to FSCA and SARS’ legal guidelines.

Have a specific question about the rules governing living annuities? Check out our living annuities FAQ page.

Evaluating The Suitability Of A Living Annuity

A living annuity is the best choice for individuals looking for a flexible retirement income solution providing investment freedom and growth potential. Everyone’s retirement needs are different, and your decision to invest in a living annuity depends on your individual circumstances, investment preferences, and financial goals. Living annuities offer more control and customisation with your retirement income, but come with investment risks and management responsibilities as you decide how you invest, and how you withdraw your pension savings.

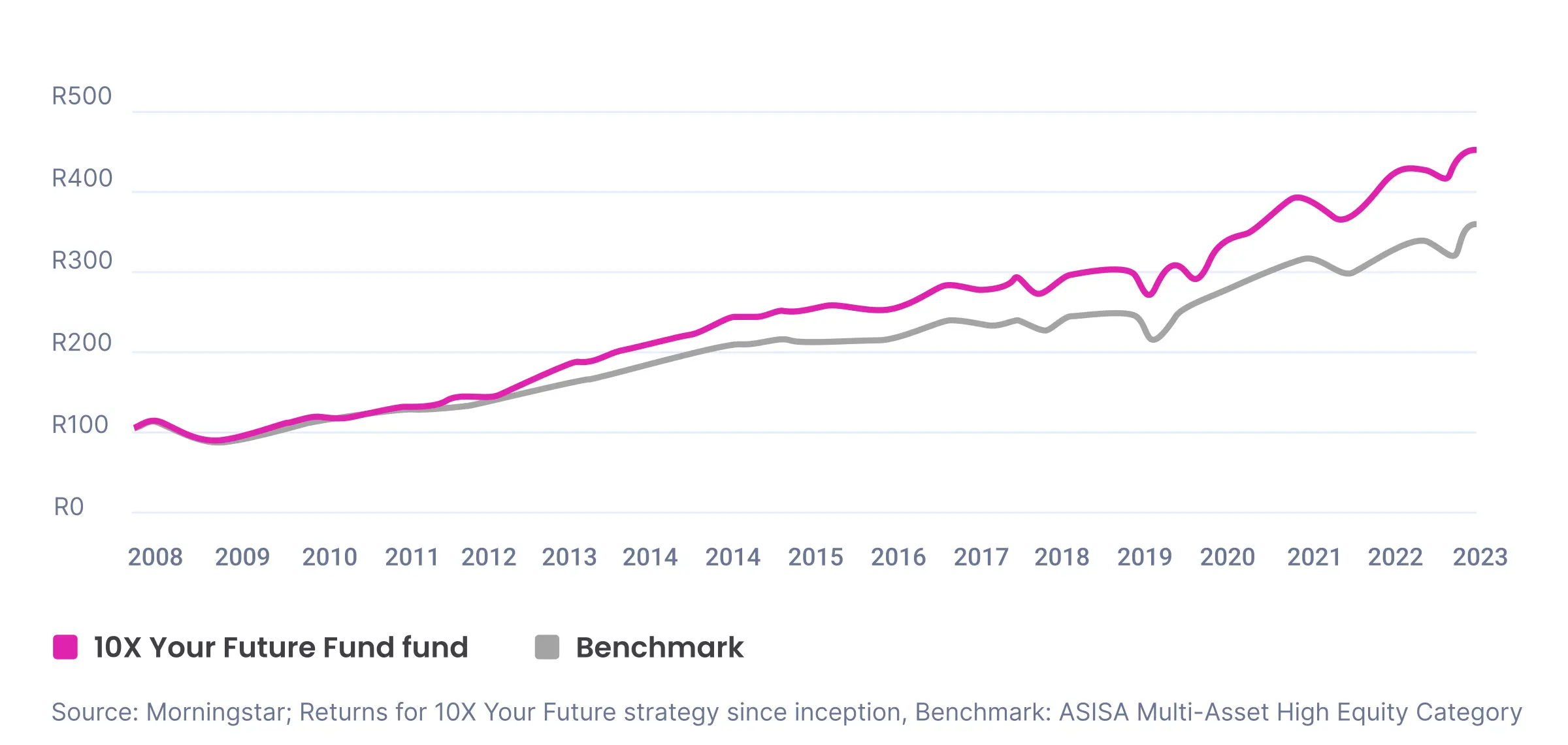

The 10X Investments’ living annuity stands out in the market due to our superior returns (which consistently outperform market benchmarks), our incredibly low fees, and our offshore investment capabilities. With 10X, you’re able to invest up to 100% of your savings offshore, allowing you access to a broad range of investment opportunities to suit your risk tolerance.

For those looking to take direct charge of their retirement savings and enjoy flexibility with how they invest and withdraw, a 10X Living Annuity is the optimal retirement income vehicle. As the first step to building your retirement income plan, you can use our living annuity calculator to map out your sustainable income goal based on your current savings and projected retirement age.

9 out of 10 people do better with 10X

Benefits And Risks Of Living Annuities

The primary benefits of a living annuity lies in the flexibility and customisation retirees are able to exercise with their income and investment choices. Annuitants are able to choose how their funds are invested within their chosen providers’ basket of investments, and have greater control over their investment strategy.

Essentially, you are able to tailor your investment portfolio according to your risk tolerance and financial goals, making living annuities an optimal choice for those wanting a more hands-on investment approach with their savings. With a LA, you are able to invest your retirement savings while drawing a regular income, and you are able to change your pension withdrawal rate depending on your needs or the performance of your investments.

Equally important to consider, are the risks that come with a living annuity. The two biggest risks to retirees considering a living annuity are a downturn in the market leading to capital loss and less money to withdraw, and the possibility of outliving your savings. For each of these scenarios, the lower your draw-down rate for your income payments, the lower your exposure to these risks. A good benchmark for most retirees is a draw-down rate of 4% or less; if you can maintain your lifestyle in or around these parameters, you’re unlikely to prematurely deplete your savings and also have the ability to recover with the market.

Central to retiring comfortably with a LA is the ability to manage the associated investment risk. For example, poor investment returns or market volatility might reduce the longevity of your savings – however, if you can mitigate periods of market weakness by reducing your draw-down rate during these times, your savings will not be as vulnerable.

With 10X Investments, we aim to mitigate the risks associated with a living annuity with our strategic asset allocation and diversified investment approach. Our portfolios consist of a robust range of investment options that consistently outperform market benchmarks, weathering changing market conditions to maximise the long-term growth of your savings.

Investment Strategies And Portfolio Management

At 10X, we understand that everyone’s retirement needs and financial goals are different, so our broad selection of funds were developed to meet the needs of just about any individual investing in their future. Selecting the right investment strategy can be a daunting process, so let’s unpack the basics of how to develop a strategy that takes into account your risk tolerance, income needs, and financial goals.

The main asset classes for LA investment at 10X include company shares (or ‘equities’), bonds, property, and cash.

1. Equities are shares of publicly-owned companies and historically generate higher returns than other asset classes, but also carry comparatively more risk. The value of company shares fluctuates frequently, but the range of investment options is big, so a greater portion of equities in a living annuity fund means your investments can still be diverse within the asset class and have the potential for good long-term returns. However, markets are volatile, and you need to consider the longer time horizons needed for your investment to recover from any market downturns.

2. Bonds represent money lent to government or corporate entities, who promise to pay a regular interest repayment on that money. Bonds have a more predictable short-term return than equities, and by their nature offer more stability. However, capital in bonds can be impacted by rising interest rates, and fixed-rate bonds may not match pace with inflation.

3. Property refers to shares in companies that derive their revenues from the property market. Investing in property-focused companies allows exposure to the real estate market without necessitating direct property ownership, which diversifies your investment portfolio. However, property shares are influenced by market dynamics (the most recent example of which would be office rental companies going bankrupt during the Covid pandemic) which poses a potential risk to stability.

4. Cash returns in a money market account typically generate relatively low returns, but come with very low risk – you are almost certain to receive all the money you put in plus interest, making cash a viable option for preserving capital in the short term. However, investing in cash leaves you more vulnerable to inflation or currency fluctuations.

No matter how you choose to invest, it is important to periodically review your investment portfolio, as well as your drawdown rate, in order to sustain and grow your retirement income long-term. Market conditions, economic factors, and individual circumstances can all be unpredictable, and can in turn impact the performance and sustainability of your retirement savings and investment.

Regularly reviewing your asset portfolio and the options available to you and staying aware of the performance of your investments helps you identify changes that would be more in line with your financial goals, risk tolerance, or circumstantial needs as and if they change. For this reason, we believe in a completely transparent approach to investment reporting, to ensure you make decisions with the full scope of your investment performance in view.

Managing Withdrawals And Income Planning

Every year you will be obligated to draw a pension from your living annuity investment. The FSCA sets the legal minimum and maximum withdrawal rates for living annuities, with the minimum being 2.5% and the maximum being 17.5% of the annual value of your residual capital upon your policy anniversary date. These rates are set in order to ensure that retirees are able to receive a sustainable income while also preserving the longevity of their savings. You can change your draw-down rate from year to year, but this change must be confirmed before the anniversary date of your policy. You can also choose the frequency of your withdrawals: monthly, quarterly, semi-annually or annually.

Alongside regular revision of your withdrawal rate, effective long-term budgeting will put you in good stead for retirement. Rather than thinking of budgeting as restricting your financial choices, consider it a way to build a roadmap towards more financial freedom. The ideal budget should be flexible enough to withstand unexpected expenses or changes impacting your income. For example, as you get older, you should consider the potential impact of health-related costs. Developing a budget allows you to feel confident and comfortable with your spending without jeopardising your financial goals – a lifestyle habit that will hugely benefit you when you reach retirement and beyond.

Tax Implications And Regulatory Compliance

As we have covered earlier, there is a regulatory framework for living annuities that informs minimum and maximum draw-down rates (2.5% and 17.5% of your residual capital respectively) as well as how you will be taxed. The major legislation covering retirement investments in South Africa is Regulation 28 under the Pension Fund Act. Regulation 28 limits the extent to which your retirement funds may be invested in particular assets or asset classes. This is to protect your retirement investment and ensure you are not taking unnecessary risks with your retirement savings.

Further to your investment security, 10X requires that you select an investment fund from the options we carry. You may switch between investment funds (without any penalty fees) up to four times a year. Please also note the following from our Living Annuity policy document:

If you select more than one Investment Portfolio, the weights of the Investment Portfolios will be automatically rebalanced back to the stated initial weight when the weights are more than 5% away from the specified initial weight.

In terms of taxation, 10X will deduct the necessary income tax from your annuity income according to the standard personal income tax payment.

Finding The Right Provider

With so many investment managers to choose from, what sets 10X Investments apart as the best choice for your living annuity? Since 2008, we have helped South Africans retire with dignity and comfort by delivering superior investment returns at consistently low costs and with a high degree of transparency. We possess a track record of 100% market outperformance that gives you the peace of mind that comes with knowing your savings are working for you.

The decisions you make regarding your retirement are big decisions, and should be handled with care. We recognise this at 10X, and so we are committed to operating with transparency and expert support at our core. Our highly experienced consultants have helped thousands of South Africans make better choices for their retirements, and they’re always just a phone-call away (no call centres here, just friendly, knowledgeable humans!).

A living annuity comes with a number of unique benefits, each with a relative consideration to bear in mind; with greater flexibility over how you withdraw and invest comes the responsibility to carefully manage your finances and investment to ensure the longevity of your savings for retirement. LAs present a retirement solution with growth potential, and with our track record of high returns, low fees, and exceptional service, the 10X Living Annuity is the optimal choice for growing your investments in retirement.

We encourage you to check out our living annuity resources, such as our 10X blog or living annuity calculator to help you begin developing your living annuity retirement plan. You can also compare your current investments to 10X, easily and for free. We pride ourselves on our robust support system; however, it is also beneficial to consult a professional investment advisor for advice tailored to your specific timeline, financial situation, and needs.

With a keen understanding of living annuities under your belt, check out our other investment offerings to learn more about your options for retirement with 10X Investments.

How can we 10X Your Future?

Begin your journey to a secure future with 10X Investments. Explore our range of retirement products designed to help you grow your wealth and achieve financial success.