How to Avoid Running Out of Money in Retirement

11 June 2024

So you’ve worked hard, put money away, and now you’ve chosen to retire (or are considering retiring soon). If you’ve saved consistently, well done! You’re in the minority of South Africans who have managed to stick to a workable retirement savings plan. Now the question is, how do you keep from depleting those savings and running out of money? Here we’ll discuss the golden ‘retirement equation’ you should use when thinking about your retirement finances. That equation is, very simply, that your ‘costs’ need to be equal to or less than the returns on your investments:

Drawdowns + Fees + Inflation ≦ Return on Investment

Before we discuss that equation in more detail, it’s worth noting that it’s not necessary to think of your retirement in terms such as ‘I was earning, and in retirement I won’t be earning any more’. Plenty of retirees work part-time or find other ways to bring in money outside of their investments, even if that money isn’t as much as they were bringing in while they were working. Exploring a ‘side hustle’ is a great way to supplement the right-hand side of the Golden Equation above.

Plan for a comfortable retirement with our

Living Annuity calculatorDrawdowns: What is a sustainable drawdown rate?

When you retire, you need to use at least two thirds of your retirement savings to purchase a living annuity or a guaranteed annuity. Drawdown rates don’t apply to the latter, as in that case an insurer is taking your retirement capital and paying you a set monthly income regardless of external factors like market movements or your own financial needs.

The uncomfortable truth about retirement in South Africa - Rands and Sense by 10X [video]

We sit down with 10X Investment Consultant lead Andre Tuck and discuss the retirement savings crisis in South Africa. We also delve into living annuities, retirement annuities, TFSAs and everything in between. Read more

![The uncomfortable truth about retirement in South Africa - Rands and Sense by 10X [video]](/_next/image?url=https%3A%2F%2Fimages.ctfassets.net%2Fyqvz0zwovkbq%2F5ipSTnRq5Dp25fyghm5kGQ%2F02c801c78d5e1ca9280bfd34d7602368%2FAndre_Tuck_podcast_cover_image__1_.webp&w=828&q=75)

In the case of a living annuity, your retirement savings are invested in an asset mix of your choice, and should be generating returns for you. Depending on your financial needs and the other two parts to the Golden Equation (inflation and fees, discussed next), the amount of money you draw from your living annuity could be greater or smaller. In South Africa, the minimum drawdown rate for a living annuity is 2.5%, and the maximum is 17.5%. Obviously, the lower your drawdown rate, the more capital you will have in your living annuity and hence the more growth you might expect, and the more sustainable the investment will be over time. Our data suggests a good rule of thumb for a sustainable drawdown rate is 4-5%.

The 4% retirement rule isn't dead (but your investment fees might kill it)

4% has historically been a good rule of thumb when it comes to income drawn down from retirement investments such as a living annuity. But is it still relevant, and when might it be too much? Read more

At 10X, we make allowances for the fact that your needs might change, and we also like to ensure flexibility when it comes to how your money is invested. You are able to change your drawdown rate once a year on the anniversary of your investment, and you can alter the makeup of the investment portfolio (the assets underlying your investment) once per quarter at no extra charge (although we caution against doing this too much, as changing too often is likely to negatively impact your your savings).

Inflation: The ever-present shrinker of buying power

Inflation is the consistent increase in the cost of goods and services and the consequent decrease in purchasing power of a currency. To see inflation in action, just think about how much a loaf of bread cost twenty years ago!

Building blocks to a lasting Living Annuity

Our panel of experts discusses living annuities, sustainable drawdown rates, offshore investing, and everything else one might need to consider to ensure a comfortable retirement. Read more

![Building blocks to a lasting Living Annuity [webinar + transcript]](/_next/image?url=https%3A%2F%2Fimages.ctfassets.net%2Fyqvz0zwovkbq%2F4dZzwtwSkZ19hmRrVa6Zyb%2F770741ecc4b2ae3deda48fa06da42718%2FWebinar_recording_cover_1920X1080.webp&w=828&q=75)

When you consider that the inflation rate in South Africa is 5-6% annually, it would stand to reason that if your investments are returning less than that, you are losing money every year, even if the initial amount you invested is growing (say by 2-3%). Inflation isn’t going away, and it is the one thing on the left-hand side of the Golden Equation that you have no control over. Thus, when considering your retirement finances, it should be the first thing you take into account.

Fees: The more you pay, the less you have, and it gets worse every year

If compound interest is the greatest builder of retirement savings, the compounding effect of high fees is surely its biggest destroyer. Consider the graph below to understand the difference in what you get out when paying 1% vs 3% in fees. This is the magic of compounding working in reverse, against you, and making sure you end up with less than you deserve. So, understand your Effective Annual Cost, and do a comparison with another provider if you feel you’re paying too much. At 10X, we’re committed to keeping fees as low as possible, and making sure our clients get the most they possibly can out of their investments.

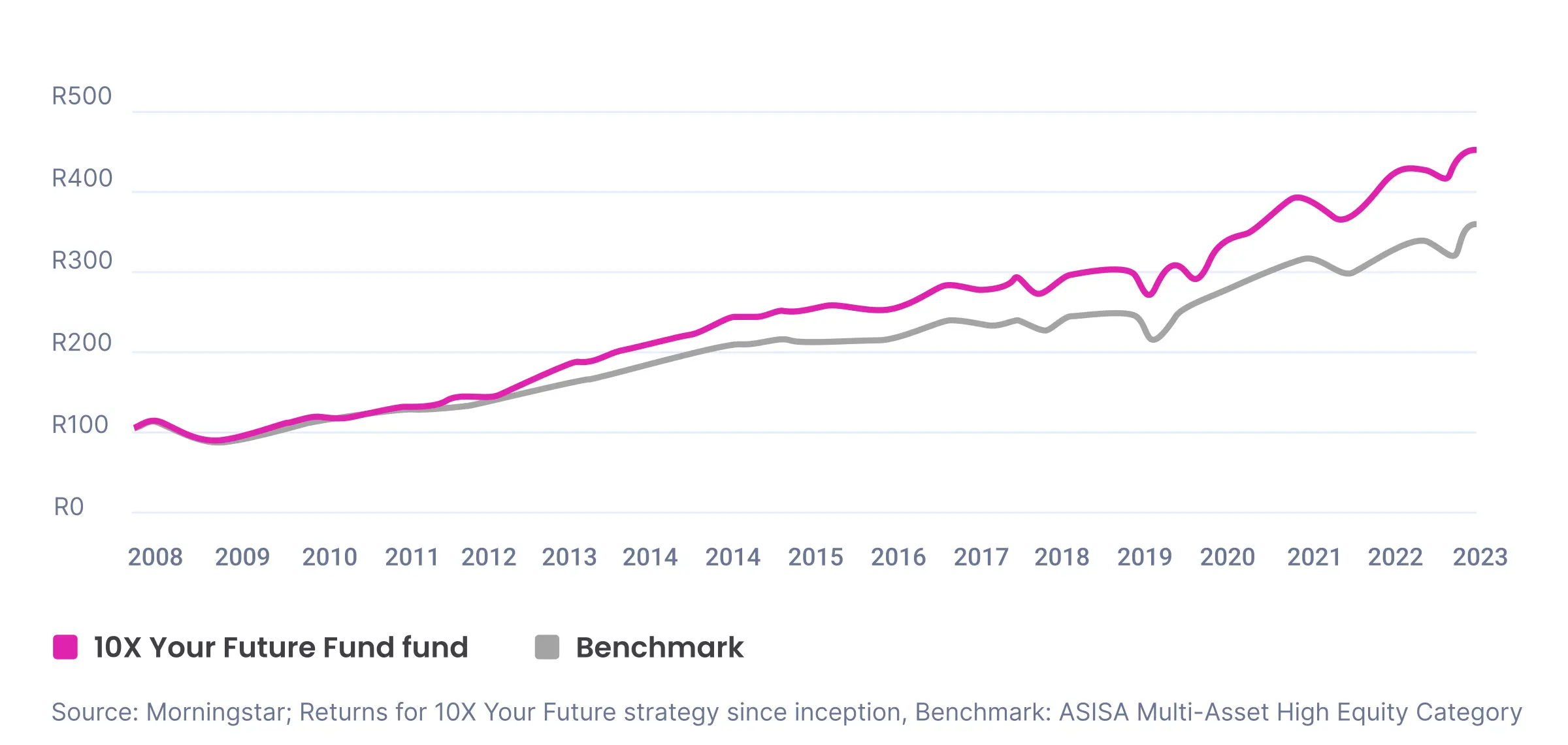

Investment returns: It’s all about beating the benchmark

The right-hand side of the Golden Equation concerns the performance of your investment. In terms of the equation, we know that your returns needs to equal to or greater than the combination of elements (drawdown, inflation and fees) on the left-hand side of the equation.

In South Africa, with annual inflation at 5-6%, a typical drawdown rate being 4-5%, and fees being anything up to 3% (or in some cases, unbelievably, even higher!), you need your investments to aim at returning 12% to be close to balancing the equation. So, understanding how your money is invested is incredibly important (and setting your drawdown rates and negotiating fees should become focal points as well).

The most important retirement decision - what if I get it wrong?

Living annuity or life annuity? Business Times journalist Nicola Mawson contemplates where to put her hard-earned retirement savings. Read more

Typically, living annuity investments are split into four main asset categories: equities, bonds, cash and property. Equities usually perform better than the other asset categories, but come with more risk, as markets (and companies!) rise and fall daily. To see a mix of assets in action, consider that the 10X Your Future Fund (which has returned 12.1% annually on average since inception and a 100% track record of benchmark outperformance) has the following asset allocation:

- SA Equity: 34.5%

- International Equity: 28.3%

- SA Nominal Bonds: 12.7%

- SA Inflation Linked Bonds: 8.6%

- International cash: 7.2%

- SA Cash: 3.1%

- International Nominal Bonds: 3.2%

- International Inflation Linked Bonds: 2.3%

- SA Property: 1.2%

If you find yourself looking at your investment statement and seeing that your returns aren’t matching up to or exceeding the ‘costs’ you are incurring on the left-hand side of your Golden Equation, it might be time to relook your investment, or do a cost comparison with another provider.

What else might go wrong with my retirement savings?

Aside from getting the Golden Equation wrong over time, the following could also cause your retirement to be less comfortable than you’d like:

- Choosing the wrong pension product. A guaranteed annuity insures you against longevity risk (the risk that you outlive your savings) as well as investment risk (depleting your capital too soon due to inadequate investment returns). But, you don’t have any control over how your money is invested, nor how much income you draw. Also, your policy dies with you, and no money passes to your heirs. A living annuity, on the other hand, transfers the risk and responsibility for securing an adequate income for life to you. In return, you have greater investment and income flexibility, and your heirs inherit whatever is left of your capital after your death.

- Underestimating your expenses. Your financial situation will change during retirement. While expenses such as school fees or bond repayments will likely fade away, your medical expenses, for example, might increase. If you don’t provide sufficiently for healthcare, your retirement could become a costly and stressful exercise in paying off medical bills.

- Panic selling. Investing in growth assets has proven to be the best way to increase your wealth. Inevitable periods of market volatility may, however, test your nerve. You might feel the urge to panic and change your asset mix when you see a sudden sharp drop in the value of your portfolio. But giving in to your emotions and switching when the market is down will likely lock in your losses and leave you with the prospect of a permanently lower income thereafter.

9 out of 10 people do better with 10X

Making sure your retirement savings are in the right place and will last as long as you need them can be a stressful process. Our highly-experienced consultants have helped thousands of South Africans achieve the retirements they deserve. If you have any questions about your retirement investments, get in touch. There are no call centres at 10X, just experienced humans who know what they’re talking about.

Related articles

How can we 10X Your Future?

Begin your journey to a secure future with 10X Investments. Explore our range of retirement products designed to help you grow your wealth and achieve financial success.