Don't understand your Retirement Annuity? It's ok! Here's the help you need.

4 February 2025

10X Senior Investment Consultant Michael Rossouw is constantly amazed by just how little clients know about their retirement savings. It’s not their fault – no one gets taught this stuff at school (and why not, South African government?). So, we asked Michael to get back to basics for us. Let’s talk retirement annuities – simply.

Build the retirement of your dreams with our

Retirement Annuity calculatorWhat is a retirement annuity (RA)?

Simply put, a retirement annuity is an investment used to save for retirement.

Why do I save towards retirement?

The money you save for retirement will help generate an income to pay for your expenses when you stop working. That income can come from a guaranteed (life) annuity, or a living annuity. You are obligated by law to use your retirement annuity savings to purchase one of those two options when you retire.

Why do I use a RA instead of a tax free savings account, a savings account with the bank or any other type of investment?

The main reason is if you’re earning a taxable income and invest in an RA, you’re not only receiving an investment return but also guaranteed tax back on top of that. Which is something none of your other investment options can give you.

Okay, now I have two questions. How does the guaranteed tax return work, and how does the investment return work?

Let’s answer those questions with a simple example

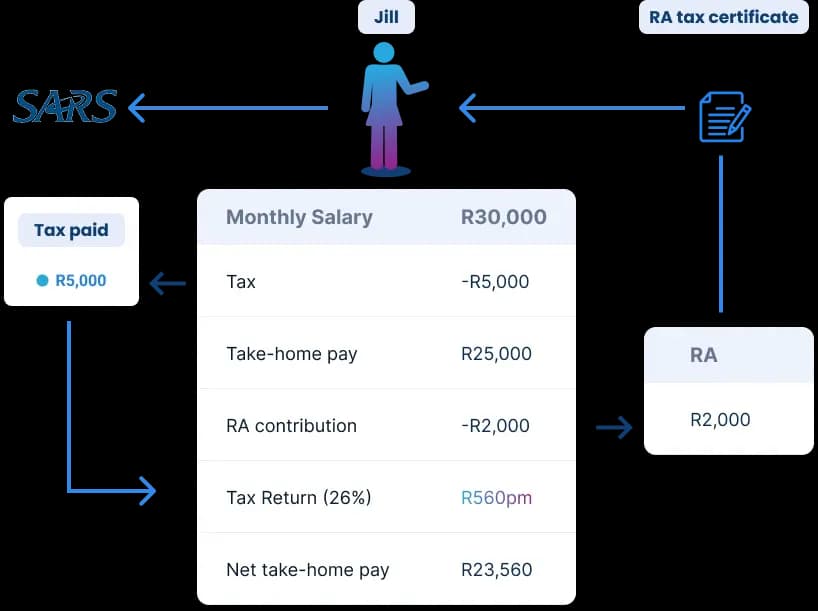

You earn a salary of R30,000 and pay tax of R5,000 (26%), taking home R25,000.

If you invest R2000 per month (R24,000 per year) into a retirement annuity that gives you 10% growth, your RA provider will give you a tax certificate to prove you invested in your retirement. You then hand that tax certificate to SARS, and they give you tax back of 26% (your income tax rate) of the R24,000, which is R6,240. Now, you can put that back into your RA, guaranteeing more tax back next year, invest in a TFSA, or just treat yourself, because you deserve it!

How does the investment return work?

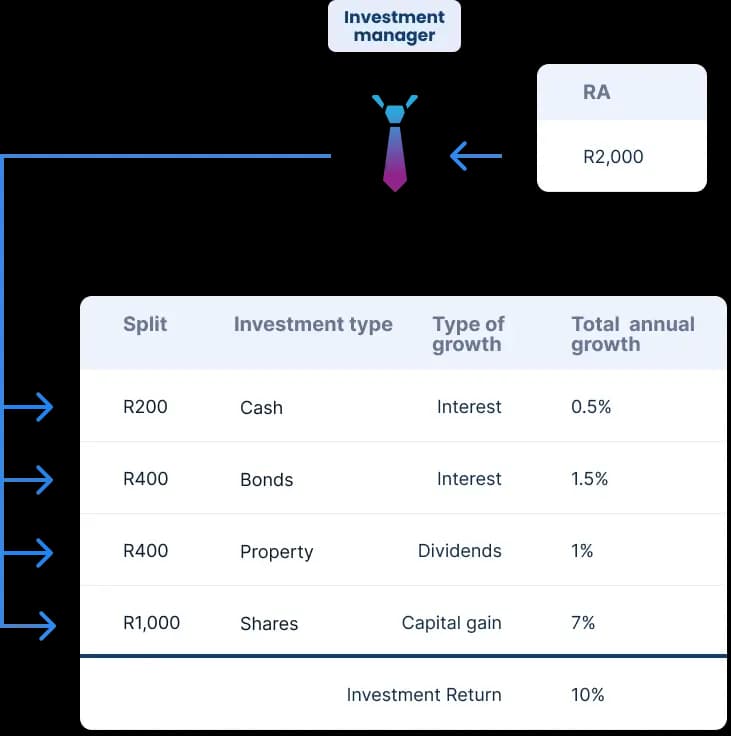

When you invest money into an RA, an investment manager spreads your money across the various equity (stocks), bonds, property and money markets.

Equity investments are a share of a company on the stock market. When the value of that company increases, the value of your share in the company increases which increases the value of your retirement annuity. We call this capital gain.

Bonds are very similar to taking out a mortgage with the bank. A person loans the money from the bank, and then pays back the amount plus interest. When you invest in bonds, you are the bank and someone (a government, a company) is paying you back.

Property investments are mainly property shares. This means you invest in a share of a company that buys properties to generate rental income. They then divide the profits and pay you dividends.

Cash investments are similar to leaving your money in a bank – that money generates interest.

By spreading your investment capital across cash, bonds, property and shares, the investment manager in the example above generates a 10% investment return on the R24,000 (or R2,400) you contributed. So, you made interest, dividends and capital gains, to give you an R2,400 investment return inside of your RA.

Ok, but why do I invest in a retirement annuity specifically?

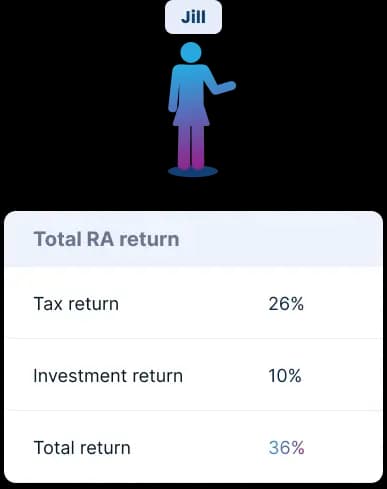

As shown in the example above, if you invest towards an RA, you save R24,000 towards retirement each year, and SARS saved R6,240 towards your retirement and the stock market saved R2000 towards your retirement. That means you received a Total Return of 36%. Try compounding that over 20 years and see how much money you will have. Hint: It’s much more than you think. Use the RA calculator below to see!

9 out of 10 people do better with 10X

Related articles

How can we 10X Your Future?

Begin your journey to a secure future with 10X Investments. Explore our range of retirement products designed to help you grow your wealth and achieve financial success.