10 things you really should know about your retirement investments

8 June 2024

Retirement investment expectations in a riskier world: your money and the market right now

Building blocks to a lasting Living Annuity

Our panel of experts discusses living annuities, sustainable drawdown rates, offshore investing, and everything else one might need to consider to ensure a comfortable retirement. Read more

![Building blocks to a lasting Living Annuity [webinar + transcript]](/_next/image?url=https%3A%2F%2Fimages.ctfassets.net%2Fyqvz0zwovkbq%2F4dZzwtwSkZ19hmRrVa6Zyb%2F770741ecc4b2ae3deda48fa06da42718%2FWebinar_recording_cover_1920X1080.webp&w=828&q=75)

As 10X specialises in retirement investment products, specifically living annuities, retirement annuities and preservation funds, we speak to a lot of folks about retirement. Over the years, we’ve empowered thousands of South Africans to make better decisions about their lives after work, and a lot of the time, the questions they have are quite similar. We’ve pulled together ten of the most common questions we get in this article.

What is the difference between a living and guaranteed annuity?

As you may or may not know, when you retire (the minimum age for which in South Africa is 55) you need to use at least two-thirds of your retirement savings (pension or provident fund, preservation fund, or retirement annuity) to purchase either a guaranteed annuity or a living annuity.

- A guaranteed annuity (sometimes referred to as a life annuity) is an insurance product where you hand over your retirement savings capital to an insurer, and they pay you a fixed income until you pass away.

- A living annuity on the other hand, is an investment product where retirement savings are invested in assets and the returns on those investments pays you an income in retirement.

In a guaranteed annuity, the insurer takes on any risks and pays you a set income, but your capital does not grow, you cannot leave anything to beneficiaries and you have no flexibility in income or capital investment. With a living annuity, you are exposed to market risk with your investments, but your capital can grow, you can choose your income level and investment portfolio, and you can leave the capital to nominated beneficiaries.

Plan for a comfortable retirement with our

Living Annuity calculatorCan I invest in both a living annuity and a guaranteed annuity in retirement?

Yes, you can split your investment savings between a living annuity and a guaranteed annuity. You can also switch from a living annuity to a guaranteed annuity, but not the other way around. This is one of the reasons you might want to have multiple living annuities, which is perfectly legal: at some point, you might want to move some of your retirement capital into a guaranteed annuity, but not all of it. You might choose to have more than one living annuity to give you this flexibility, as you cannot take a portion of a living annuity and convert it - you must convert the entire fund.

How does a living annuity aim to beat inflation consistently?

In a guaranteed annuity, insurers invest you money in low risk assets and you benefit from pooling benefits. With a living annuity, you can choose to invest in assets (such as equities and property) that have a much better chance of consistently beating inflation, and therefore actually growing your retirement savings (assuming your drawdowns and the fees you pay do not deplete the remainder of those returns).

How do I set my living annuity drawdown rate so that I don’t run out of money in retirement?

In South Africa, the minimum drawdown rate on a living annuity is 2.5% and the maximum is 17.5%. Obviously, the lower your drawdown rate, the more sustainable the fund over time. A good rule of thumb for a sustainable drawdown rate is 4-5%. The ‘Golden Equation’ here is that Drawdowns + Inflation + Fees should be less than or equal to Returns On Your Investment. That way, you will never run out of money.

The Rule of 4%: Will Your Retirement Savings Last?

Explore the 4% rule for retirement withdrawals and understand how fees impact your retirement income. Learn about sustainable drawdown rates, the effects of inflation, and how to make your retirement savings last longer with 10X's low-fee approach. Read more

What is my Effective Annual Cost (EAC), and how do fees impact my investment?

It is absolutely critical that you understand your Effective Annual Cost (EAC). This is the total amount you pay as a percentage of your investment, and can be made up of management fees, advice fees, platform fees, and potentially a whole bunch of other things you didn’t know you were paying for. Higher fees can have a massive negative impact on your investment and your retirement income - for just as compound interest on your investment grows your savings, your fees compound as well, just in the other direction. Did you know a 1% difference in fees can mean as much as 30% less money in retirement? If you don’t know your EAC, ask your broker or your service provider to break it down for you, or do a free cost comparison with 10X.

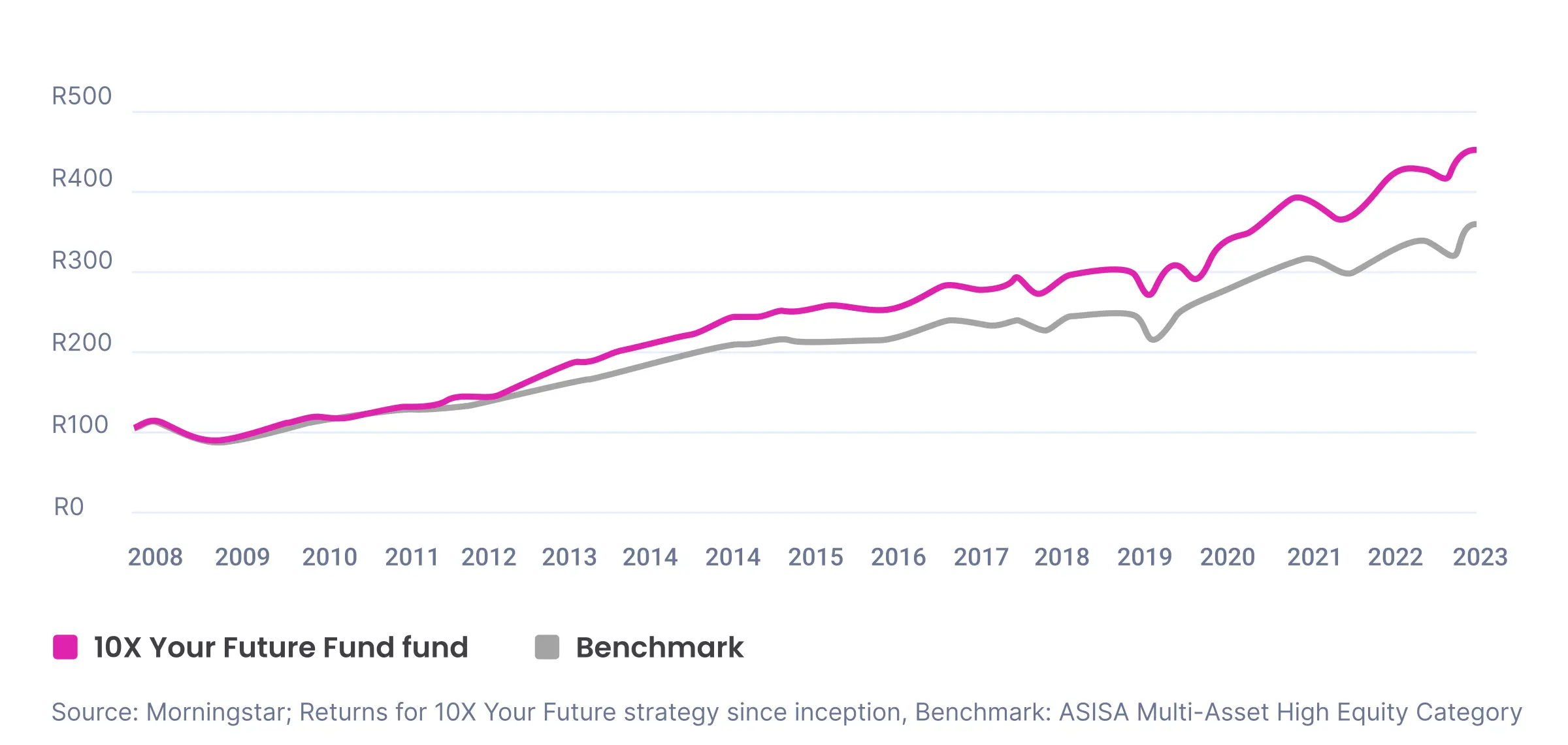

9 out of 10 people do better with 10X

Can I change the asset allocation in my living annuity?

Absolutely. Diversifying investments helps to mitigate risk, and you need to invest in the correct asset allocation for your time horizon. At 10X, you can review your asset allocation and change it up once per quarter (although we do caution against doing this too often as we take a long term view towards performance and our fund selections reflect this).

How much offshore exposure do I want in my living annuity?

Firstly, a living annuity is not governed by Regulation 28 in the Pension Act, so there is no limit to the amount of offshore investment you can make. Offshore investments offer exposure to fast-growing international industries, and diversification away from country-specific risks. In terms of amount of offshore exposure, you need to make sure you are matching your assets and liabilities - if much of your total wealth (house, business etc) is in South Africa, you may want more offshore exposure in your living annuity. But take note of exchange rate fluctuations: the Rand is volatile! Our data suggests between 40% and 60% offshore investment offers a good range for a Rand-based investor.

The uncomfortable truth about retirement in South Africa - Rands and Sense by 10X [video]

We sit down with 10X Investment Consultant lead Andre Tuck and discuss the retirement savings crisis in South Africa. We also delve into living annuities, retirement annuities, TFSAs and everything in between. Read more

![The uncomfortable truth about retirement in South Africa - Rands and Sense by 10X [video]](/_next/image?url=https%3A%2F%2Fimages.ctfassets.net%2Fyqvz0zwovkbq%2F5ipSTnRq5Dp25fyghm5kGQ%2F02c801c78d5e1ca9280bfd34d7602368%2FAndre_Tuck_podcast_cover_image__1_.webp&w=828&q=75)

Can I switch between retirement annuity or living annuity providers?

Yes, in both cases. For a living annuity, the change is known as a Section 50 transfer. Importantly, there is no disruption in monthly income. There are generally no fees (or very small fees) involved in switching living annuities. Be sure to negotiate any switching fees you might be charged by a provider - you can often knock them down substantially. Finally, you should consider doing a free cost comparison report to see if switching to 10X might be worth it.

How is my retirement income taxed?

Income from a living annuity or a guaranteed annuity is taxed as income and you will pay PAYE on that income. With a living annuity, your income is taxed, but growth in the investment is not. Any capital remaining in the living annuity after your passing is not included in estate duty tax.

Can I leave my living annuity capital to nominated beneficiaries?

Yes. Any capital left in your living annuity after your passing does not form part of your estate - you decide who that capital goes to. Your beneficiaries can take the capital as a lump sum, or annuitise the capital by purchasing a living annuity of their own.

If you have further questions about your retirement investments, get in touch with one of our highly-experienced consultants. There are no call centres at 10X, just knowledgeable humans ready to help.

9 out of 10 people do better with 10X

Related articles

How can we 10X Your Future?

Begin your journey to a secure future with 10X Investments. Explore our range of retirement products designed to help you grow your wealth and achieve financial success.