Retirement Annuity FAQs

A retirement annuity is a long-term investment designed to strengthen retirement savings and prepare individuals for a more comfortable retirement. By making regular contributions to your retirement annuity, you can set yourself up for a stable financial future – harnessing the compound interest in an annuity fund that could significantly boost your savings. With such a diverse range of retirement annuity providers available, and with each offering a slightly different take on the product, having a solid understanding of your individual needs is crucial to deciding which retirement annuity will best suit you. We hope this comprehensive question and answer document empowers you to make the best decision for your retirement.

Contents

What Is A Retirement Annuity?

A retirement annuity is a financial product designed to provide a retirement savings vehicle that provides income during retirement after it is converted into a living or life (guaranteed) annuity, sometimes referred to as an income annuity. An individual invests money via a financial institution and, upon retirement, that investment then pays out an income based on their chosen investment structure.

Build the retirement of your dreams with our

Retirement Annuity calculatorWhy use a 10X Retirement Annuity to save for retirement?

An appropriately structured retirement annuity can form the cornerstone of your retirement savings plan (and broader investment plan), especially considering that it is required to be converted into income-generating annuity products – a living or life (guaranteed) annuity – upon reaching retirement age.

The extensive range of retirement annuities available includes options with varying levels of risk, different investment strategies and higher or lower fees. All of these factors should be considered carefully. After all, it’s not about picking just any annuity fund; you are setting out to secure an investment that aligns with your risk tolerance and retirement goals. With that being said, some individuals may harbour reservations regarding retirement annuities due to perceived high fees, inconsistent fund performance, or a minimal understanding of the intricacies of various annuity offerings.

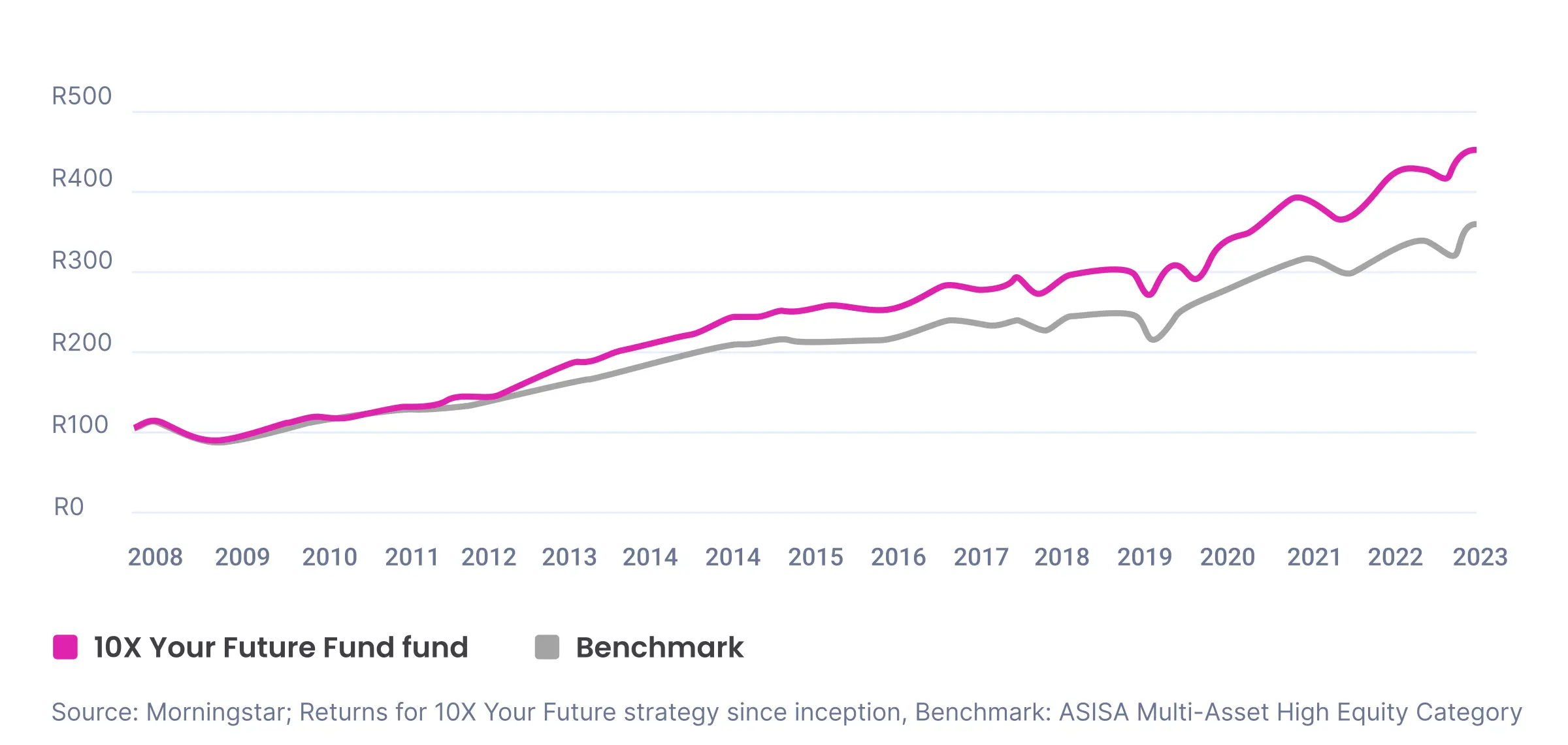

10X serves to address these hesitations head-on by offering transparent fee structures, superior fund performance (with a 100% record of market outperformance), and comprehensive educational resources. Our goal here is to discuss retirement annuities, dispel misconceptions, and instil confidence in those looking into retirement planning. By prioritising affordability, consistent performance, and client support, the 10X Retirement Annuity can set you up for success, allowing you to invest with confidence and peace of mind. Commit to your financial well-being in the future and let 10X Investments assist you on your retirement journey.

Is It Worth Having A Retirement Annuity?

A retirement annuity fund can form the cornerstone of a worry-free retirement, ensuring financial security and consistent income after leaving the workforce. With a retirement annuity, invested capital is protected from creditors, and individuals benefit from tax advantages, thereby being incentivised to save for the future, with the additional security of potentially more stable finances in retirement and potentially less risk of outliving one's savings.

Can I Withdraw My Retirement Annuity Early In South Africa?

The short answer is no, not before you are 55 years old. However, the legislation does provide for a 100% withdrawal should your investment be less than R15,000 on the date it is paid. Early withdrawals or cancellations may also result in surrender charges which can significantly reduce the amount of money you receive back. 10X Investments, on the other hand, aims for transparency with a progressive fee structure and no upfront fees, advice fees, exit fees or penalty fees.

Under the new two-pot legislation, your RA capital is divided into a savings pot and a retirement pot. You are allowed one withdrawal from the savings pot per annum, at a minimum of R2000. That withdrawal will be taxed according to your marginal tax rate.

Can I Transfer My Retirement Annuity To Another Provider?

In terms of transferring your retirement annuity to another provider, this is referred to as a Section 14 transfer following the Pension Funds Act, and you are free to move your retirement annuity to the provider of your choice. Your investment will not be taxed during this process. Unlike larger insurers who often charge exit fees to cancel your policy, 10X charges no penalty fees or exit fees, offering a far more flexible structure with no hidden costs.

Can I Cancel My Retirement Annuity And Get My Money Back?

As mentioned above, you can withdraw all the money in your retirement annuity if the amount is less than R15,000 on the date it is paid. In that sense, you can cancel your retirement annuity and get your money back. If you no longer want to contribute to a retirement annuity, and your investment is larger than R15,000, you would need to wait until you are 55 to access that money. In the interim, you can transfer your RA to another provider, but it will still need to be held there until you meet the minimum age of retirement (55). Some insurance companies and financial institutions will charge a penalty fee to transfer your RA. Rest assured, 10X charges no such fees.

How Much Is A Retirement Annuity Per Month?

The minimum monthly contributions for a retirement annuity will differ from provider to provider, as will the fees they charge for their services. The 10X Retirement Annuity has a minimum contribution of R500 per month or an initial lump sum investment of R5,000. However, we know that life happens, and you are welcome to pause contributions if you need to.

Fees are typically charged as a percentage of the invested amount, and anything over 2% is on the high side. Clients also pay less the more they invest, with a sliding scale of fees according to the invested amount. More details on fees can be found on our retirement annuity page.

Limiting the impact of fees is crucial to getting more money out when you retire. Consider a 2% difference in fees as illustrated below:

We can see how a small difference in fees can lead to major differences in retirement outcomes, highlighting the importance of using a low fee provider. Note that this example is for illustrative purposes only, and real results may vary. You can find out more about how fees affect retirement outcomes here.

Do I Pay Tax On My Retirement Annuity?

Contributions to a retirement annuity are eligible for tax deductions, within the legislated limits of 27.5% of taxable income to a maximum of R350,000. This can substantially lower your taxable income and tax bracket. Additionally, any investment growth within the annuity is tax exempt.

Retirement Annuity Calculator

When it comes to preparing for the future, you don’t need to be super rich in order to retire comfortably – all you need is a stable foundation of savings. To secure a comfortable retirement it's imperative to (i) get started early and (ii) save the right percentage of your income consistently. A retirement annuity investment can assist in this regard, offering a viable way to save money that has real tax benefits, is safe from creditors and can ensure a steady stream of income after you have decided to retire.

These long-term investments exist to give you greater peace of mind as you transition into your golden years. If you find yourself wondering whether or not your current savings can facilitate your retirement goals, or if you are simply unsure of just how much you need to save to reach them, try out our retirement annuity calculator and find the answers you are looking for. A retirement calculator can help you prepare for retirement with informed, educated decisions.

Build the retirement of your dreams with our

Retirement Annuity calculatorRetirement Annuity vs Pension Fund

While a retirement annuity and pension fund may sound similar on paper, there are a few differences between the two retirement products. Despite their differences, both are often used together as the basis of a solid retirement plan.

Retirement Annuity

A retirement annuity is typically an individual retirement savings plan, meaning an individual (as opposed to an employer) will contribute to their own annuity held in their name. Moreover, the contributions made to a retirement annuity can be invested in various assets via funds with different strategies. RA’s are flexible in this regard, allowing the investor to make decisions about where their money is invested. This is usually not the case with a pension or provident fund. After retirement, the accumulated funds within the retirement annuity are converted into either a living annuity or a life (guaranteed) annuity, which produce taxable income for the investor. As mentioned, these retirement funding plans offer flexibility, with individuals being able to choose exactly how much they want to contribute and when (within parameters dictated by the provider).

In the case of 10X retirement annuities, individuals are also able to pay lump sums and adjust their contributions to accommodate shifting financial circumstances. Contributions to a retirement annuity are also tax-deductible, meaning investors are able to reduce their taxable income by funnelling payments into their retirement annuity, thus lowering their overall tax liability. Alongside this, investment growth within a retirement annuity fund is tax-deferred, meaning one would not be required to pay taxes on investment gains while the funds are in the retirement annuity. Only after retirement, once the investment has been converted and when payments are made to the individual, will that money be subject to income tax. It’s also worth noting that transferring money from one retirement annuity provider to another will not trigger tax liabilities.

Pension Funds

On the other hand, pension funds are typically employer-sponsored retirement plans. Contributions to these funds are often made by both the employer and employee, with the funds being managed by a trustee appointed by the pension fund. If an individual were to change jobs, they would need to make a decision as to where the pension money they had saved until that point would go after they finish up with their employer. One option is a preservation fund, which is a Regulation 28 retirement savings vehicle that protects the capital the employee has saved in their pension fund. Read more about 10X’s preservation funds here.

When compared to retirement annuities, pension funds are unable to offer the same level of flexibility in terms of contribution amounts and investment choices. These decisions are often managed by the pension fund’s trustees rather than the individual, with employees having limited control over their pension contributions. Similarly to retirement annuities, pension fund contributions are tax-deductible according to certain limits set by tax authorities, and investment growth within pension funds is also tax-deferred. Lastly, much like retirement annuities, income received from pension funds converted into an annuity at retirement is subject to income tax.

In terms of investment control, retirement annuities tend to offer individuals more control over how their funds are invested, with the option to decide on funds with different asset allocations according to personal risk tolerance and investment goals. Pension funds, in contrast, can be slightly more limiting, with the individual having less control over investment choices, as their pension would likely be part of a group scheme.

When it comes to payout options, both retirement annuity and a pension fund investments can be used to purchase an annuity that provides a regular income stream after retirement. Currently, investors are also able to withdraw one-third of their savings in a lump sum amount upon retirement. Annuity payouts are usually flexible in terms of timing, with monthly, quarterly or annual payments being possible as income.

To conclude, retirement annuities offer increased ownership and individual control over contributions and investments. The suitability of either a retirement annuity or pension fund (and in some cases, both) ultimately depends on individual preference and employer mandates, and having the right information on each option. Feel free to contact one of our 10X consultants and let us set you up with the knowledge you need to succeed.

Understanding Retirement Annuity Withdrawal

A retirement annuity (RA) is designed for long-term retirement saving, which means access to your money is intentionally restricted, as the investment forms part of the retirement component under South African retirement fund legislation. The whole idea is for it to serve as a retirement income solution once it is converted to an annuity upon retirement, so keeping your savings invested until this point is paramount. As such, you can’t withdraw all your retirement funds from a retirement annuity before age 55, irrespective of whether you stop contributing, change jobs or experience financial difficulty.

However, under the new two-pot legislation, your RA capital is divided into a savings pot and a retirement pot. You are allowed one withdrawal from the savings pot per annum, at a minimum of R2000. That withdrawal will be taxed according to your marginal tax rate.

At retirement age, you may access your retirement annuity as follows:

- Up to one-third of the total value may be taken as a lump-sum cash withdrawal, which is subject to retirement lump-sum tax tables.

- The remaining two-thirds must be used to purchase an annuity, which provides retirees with a regular retirement income.

If the total value of your retirement annuity at retirement is R15,000 or less, you may withdraw the full amount in cash. In the event of a death before retirement, the benefit is paid to your beneficiaries in accordance with retirement fund legislation. While you can’t withdraw early, you can transfer your retirement annuity to another provider without triggering tax or penalties, provided it follows the regular legal process, so you can retain the long-term benefits of a tax-deductible retirement investment that forms part of a broader retirement plan.

The 10X Retirement Annuity: The Best Option To Fund Your Life-After-Work

A retirement annuity is a responsible choice for individuals seeking a reliable and, assuming your fees aren’t exorbitant, cost-effective solution to their retirement savings needs. Alongside tax benefits, those who invest in retirement annuities can save consistently and have those savings protected from creditors (and themselves!) until they reach retirement age (the minimum age for retirement in South Africa is 55).

10X retirement annuities take things a step further, boasting a track record of 100% market outperformance, low fees, and a diversified portfolio, As well as 16 years of focused retirement experience and personalised service (no call centres here!). By saving the right amount each month, keeping fees low with the help of 10X’s progressive fee structure, and investing in a portfolio appropriate to your life stage, you can significantly boost your chance at a comfortable, secure retirement.

Secure A Stable And Prosperous Life With A 10X Retirement Annuity

Among the slew of retirement annuity options on the market, 10X retirement annuities stand out with compelling attributes like consistent inflation-beating returns, affordability, and flexibility, the latter two of which should be primary considerations of any retirement investment plan. 10X retirement annuities put these concerns to rest with a minimum contribution requirement of just R500 per month (while also being flexible about how it is applied - if you need a break for a few months, no problem), thus broadening accessibility and giving individuals the ability to respond to their life circumstances better. Alternatively, investors can opt for a lump sum contribution of R5,000. Any investor who wants to invest in a 10X RA but doesn’t meet these criteria should still speak to our consultants – we are a client-led business and will always try to make a plan around what works for our clients.

When considering retirement annuities, clients are often turned away from retirement investing by unnecessary charges or fees, and subpar returns. The 10X Retirement Annuity and the underlying 10X Your Future Fund effectively mitigate these risks, ensuring a robust investment vehicle that not only safeguards retirement savings, but also enhances returns.

Low fees mean more money for you

Fees play a pivotal role in determining returns in the case of retirement savings, and high fees can significantly erode investment growth over time. Our fees, however, are fair and transparent, with customers benefiting from a sliding scale fee structure starting from 1.04% including VAT and trading costs. With the 10X Retirement Annuity, the fee structure is simple; the more you invest, the less you pay. And you can rest assured that there will be no hidden costs cropping up at the end of the month.

With no upfront, advice, or exit fees, and no penalties for changing your investment strategy, the 10X Retirement Annuity fund is positioned favourably against both life insurance companies and other investment providers – allowing clients to maximise retirement savings without incurring excessive costs. With a competitive fee structure and superior fund performance, the 10X option is the ideal way to make your retirement annuity work for you. For more details, take a look at this 10X investment report.

Our funds perform consistently, so your investment grows

The performance of underlying funds is another critical factor that can influence the long-term growth of your retirement savings. A 10X Retirement Annuity offers a selection of five standard Regulation 28 funds (more detail on which can be found below), each conscientiously curated to deliver optimal returns and mitigate risk. The consistent market outperformance of these funds, and subsequent confidence of clients regarding the growth potential of their nest eggs, is another significant factor that sets 10X apart from alternative options.

Our commitment to transparency empowers you

Other factors that tend to dissuade individuals from investing in a retirement annuity are the supposedly complex nature of retirement planning and the opacity of the processes around transfers and drawdowns. 10X is here to streamline the entire process with a commitment to seamless, efficient, and always-reachable client service. Regardless of whether you submit a larger investment requiring processing over a period of months, or a smaller commitment to be finalised within a week or two, the 10X team ensures a hassle-free experience for clients. With a 10X Retirement Annuity you can say goodbye to complicated administrative processes, and look forward to a quick commencement of retirement savings. And when the time comes to make a decision on what to do with those savings, we’re here for you too.

Retirement expertise whenever you need it

Above and beyond our product features, 10X is committed to client support and customer education, offering personable assistance through every step of the administrative process. Our comprehensive resources and investment consultants’ expertise empowers clients to make knowledgeable decisions and maximise efficiency in their investment strategy. Want to speak to an experienced consultant about your retirement? Pick up the phone and they’ll be ready. There are no call centres at 10X! With the backing of 10X Investments, you are sure to be able to navigate retirement funding effectively, with a comprehensive retirement annuity ready to serve as a steadfast source of income when you head into your golden years.

Invest In Your Retirement Annuity With A Choice of 10X Investment Funds

An important part of retirement planning is to find a retirement-focused investment fund that can work in tandem with other saving and investment plans. Diversifying your portfolio and including a retirement annuity in your overall plan can help create financial security. A solid and prosperous retirement hinges on selecting the right retirement annuity plan, with every other investment serving as fortification to this stable foundation. At 10X we help you transform your retirement savings into an income-generating vehicle through access to a diversified set of investment funds that underpin our retirement annuity product.

The two components of a successful retirement investment are the performance of the funds underlying the investment vehicle, and the fees associated with it (obviously, we’re not discussing potential withdrawals here – taking money out of the investment every year as taxable income will reduce its value. The point is that the investment should ideally still grow over time, as performance is strong and fees are low). Rest assured, we keep fees as low as possible, and offer consistently market-beating returns.

As our client, you are free to choose a 10X fund for your retirement annuity that best suits your financial goals. Our Flagship Funds include:

- The 10X Your Future Fund – a cost-effective, multi-asset high equity fund with a time horizon of five years or more, designed to maximise long-term capital growth.

- The 10X Income Fund – a cost-effective, multi-asset fund set up to secure a high income and long-term capital stability with a time horizon of three years or more.

A few more fund options include:

- The 10X Moderate Fund – ideal for investors who seek capital growth with a lower level of volatility over the medium/long term.

- The 10X Defensive Fund – suitable for investors seeking a steady level of income alongside capital growth via cost-effective exposure to local and international asset classes.

- The 10X Money Market Fund – for those seeking both income and capital preservation in line with Regulation 28 compliance.

If you are unsure of which plan will work for you, don’t hesitate to reach out and speak to an experienced 10X retirement consultant. Our team is ready and waiting to equip you with all the information you need to make an informed decision that will serve you for years to come. Or, if you are eager to get started straight away, navigate to our self-help portal and start saving in a matter of minutes.

Invest In The Best Retirement Annuity South Africa Has To Offer

On your search for the best retirement annuity South Africa has to offer, consider 10X. 10X Investments is a licensed financial services provider and pension funds administrator with the goal of helping investors secure more money during retirement. Our retirement annuity investment solution upholds this goal, highlighting three investment principles that underlie the 10X life-stage investment portfolios – long-term strategic asset allocation, diversification, and incredibly low fees.

10X Investments is trusted by leading companies including Virgin Active, DHL, Deutsche Bank, EOH, ISUZU, and African Bank, who value 10X’s 100% market outperformance track record and personalised service.

Retirement annuity plans play a pivotal role in securing a stable financial future, with the 10X retirement annuity offering the benefit of low fees, consistent performance, and transparent expertise. We’re here to build financial security and generational wealth for our clients, and we take our mission very seriously. With a well thought-through approach to your retirement planning, flexibility in contributions, and backing from 10X, you can ensure that your retirement is not only adequately funded but also hassle-free, allowing you the peace of mind you deserve.

10X Investments is an authorised Financial Services Provider (FSP number 28250). The content herein is provided as general information and is not intended as nor does it constitute tax, legal, investment, or financial advice as defined by the Financial Advisory and Intermediary Services Act, 2002.

How can we 10X Your Future?

Begin your journey to a secure future with 10X Investments. Explore our range of retirement products designed to help you grow your wealth and achieve financial success.